The U.S. economic system advantages some and disadvantages many. In particular, African-Americans, Latinos, and women have faced historic, embedded discrimination —reinforced by institutional policies. This has created and sustained wealth inequality.

Misconceptions that racial wealth disparities result from individual choices are obstacles to systemic change. But research busts these damaging myths: attending college, raising children in a two-parent household, working full time, spending less—none of those personal behaviors can alone close the wealth gap. For women, the wealth gap has been largely overlooked in discussions of women’s economic security. These gaps, compounded by injustices in our tax system, impact the next generation. Funders who want to build assets for low and middle income families are finding ways to provide opportunity across race and gender.

The Wealth Gaps

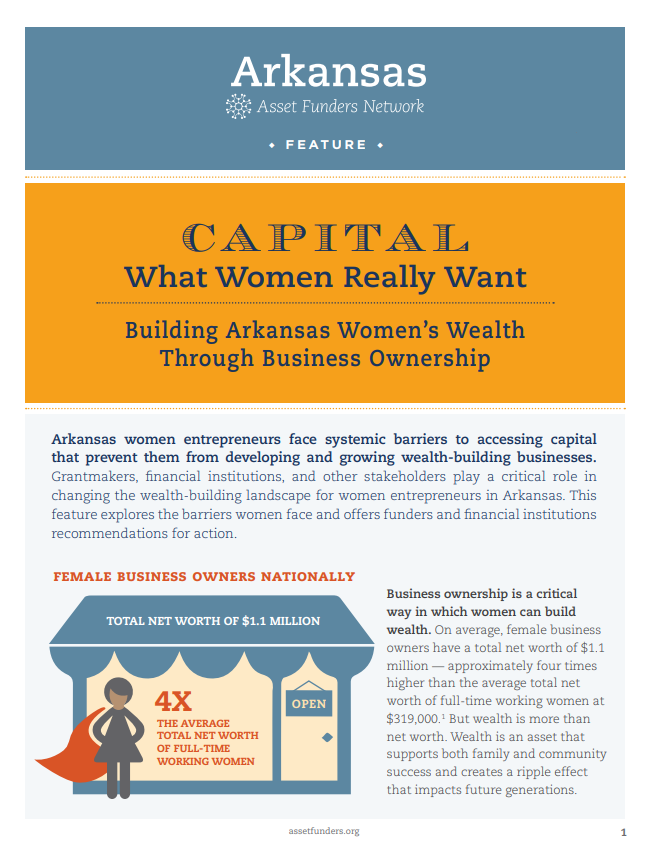

The Racial Wealth Gap is the continuing result of systemic discrimination and the intentional damages imposed by the racialized denial of equal opportunity over decades. Research to-date establishes that there is a separate wealth gap reflecting the economic damage imposed by gender discrimination that can stand alone from or act as a multiplier of the racial wealth gap effects. The Women’s Wealth Gap is a complex challenge requiring policy reforms, programmatic initiatives, capital investment, and focused products. AFN’s briefing series explores the impact and economic obstacles placed on women throughout their life cycle and recommends strategies to support women to build assets.

Tackling Debt: Addressing the Racial Wealth Gap in the South

AFN’s Tackling Debt focuses on the types of debt that trap families and are a pervasive impediment to wealth building—education, health, or justice. It also highlights a philanthropic strategy to address debt for households in the southern U.S.

AFN Resources

Why It’s Important

AFN members explore and promote grantmaking strategies that can help build wealth for historically-disadvantaged individuals and families.

Fiscal stability brings greater capacity to manage emergencies

More prepared for children’s educational needs

Improved health outcomes

Increased economic activity and local prosperity

Systemic solutions disrupt assumptions and policies that reinforce gaps

Improved post-secondary educational outcomes

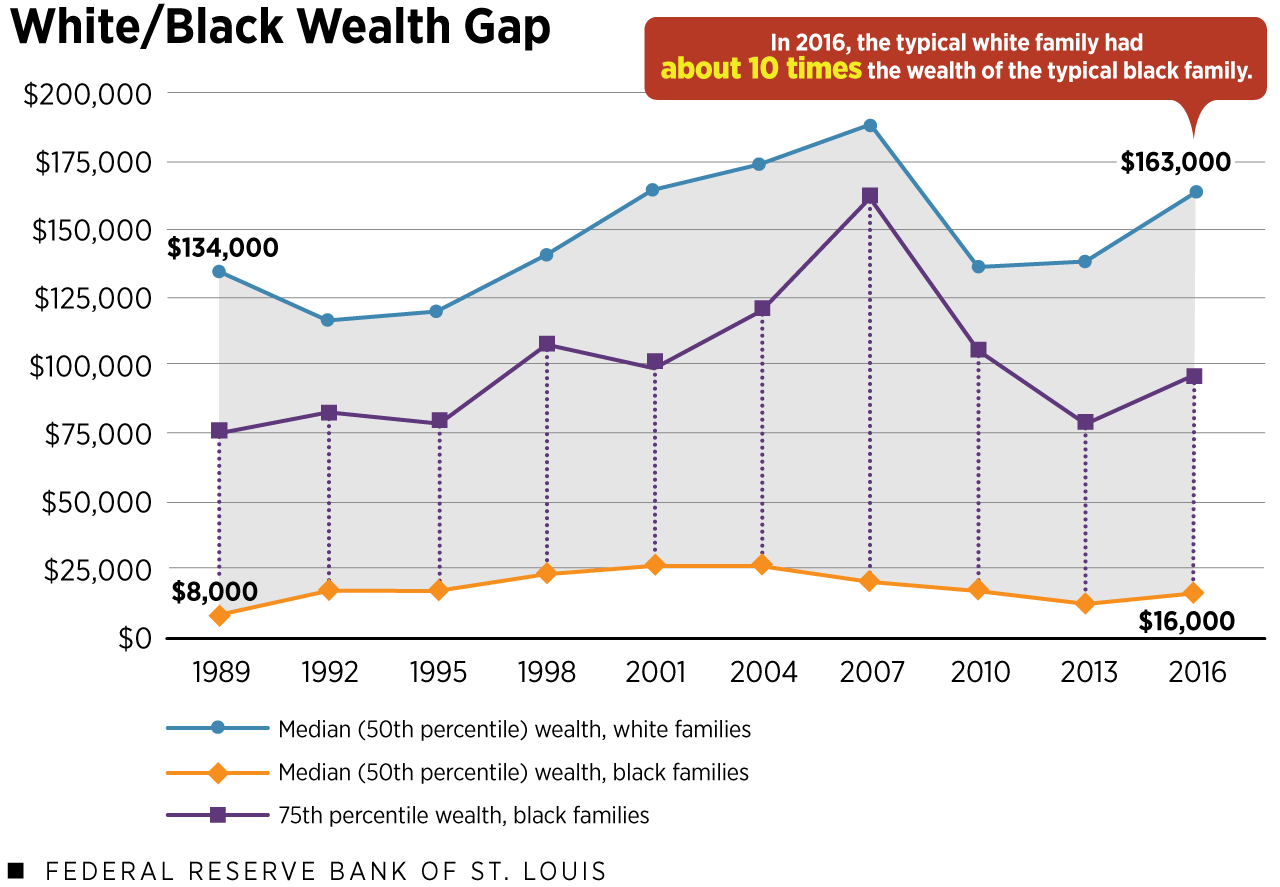

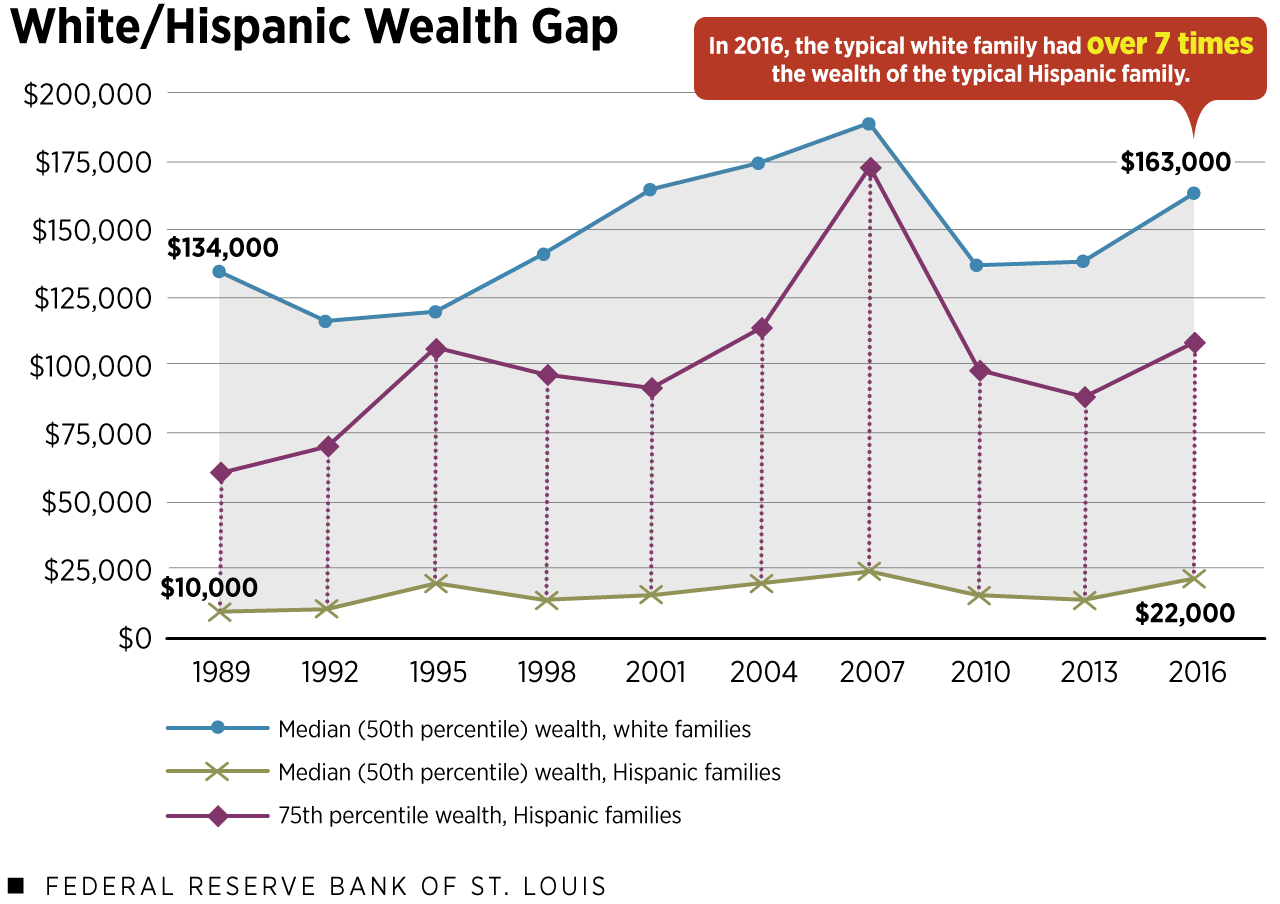

Grantmaking Strategies

With white households’ median wealth 12.9 times greater than black households and 10.3 times greater than Latino households, grantmakers are focused on finding ways to address this devastating wealth gap and the damage it causes. Some serve as conveners to build awareness of systemic barriers. They build relationships between stakeholders—like banks and community groups—needed to catalyze change. Funders also catalyze change themselves through investments to dismantle inequities.

Strategies to reduce the racial wealth gap certainly include savings programs and credit building. Beyond those building blocks, some funders are zeroing in on another root cause: the lack of business and financial assets. People of color have historically been challenged to secure the resources—such as capital, education, and experience, as well as access to markets—needed to start and grow businesses. So, funders support micro- and small-business development by addressing the needs of African-American and Latino entrepreneurs.

Funders concerned about the gender wealth gap seed and grow programs to serve a continuum of women’s needs as well. Some programs provide affordable and available child care while others support affordable college completion. Some initiatives build paths to attainable home ownership while others build attainable vehicles to grow retirement assets.

Grantmakers are also tackling the need to change federal and state tax policies. Right now, household savings and investment incentives are not accessible to the least economically mobile. Funders have opportunities to participate in tax reform coalitions, weave tax policy reform into current funding arenas, and support research and communications campaigns to both educate and move people to action.

AFN members explore and promote grantmaking strategies like these that can help build wealth for historically-disadvantaged individuals and families—wealth that creates a reservoir in times of need.

““We all do better when we all do better! Most industries don’t want to leave half of Americans behind to build wealth in this country. What gives me hope is that funder tables like the Asset Funders Network have continued to keep the hope of assets for all Americans alive. It’s the right dream, and I look forward to the years ahead, the future breakthroughs, and seeing more Americans have a real chance at building wealth.”

Lisa Mensah | Oregon Community Foundation

Accelerating Ideas Into Action

At the AFN May 2019 conference Accelerating Ideas into Action, we explored the ways where we live, work, and play, influences our ability to build assets, and shared how grantmakers are joining forces to invest in neighborhood development and individual wealth building to yield better individual asset and community outcomes.

Keynote speaker, Felecia Wong, PhD, president of the Roosevelt Institute, pulling from both her expertise and personal experiences, provided an “outside in” view of philanthropy’s role in racial equity and wealth equity work, helping our audience recognize aspects of the US economy that have systemically benefited some and excluded others, and showing us all some practical pathways for mitigating the harmful consequences of those systematic disparities.