Arkansas AFN is a regional chapter of grantmakers who advance equitable wealth building and economic mobility. Members include private, public, corporate, and community foundations, public-sector funders, and financial institutions who want to help Arkansans secure economic stability, for now and for years to come. Arkansas AFN connects funders and their peers in the nonprofit, public, and private sectors.

Arkansas AFN was launched in 2016 as a regional affiliate of national AFN by a core group of funders including the Winthrop Rockefeller Foundation, Entergy Charitable Foundation, the Carl B. and Florence E. King Foundation, Southern Bancorp Community Partners, and the Federal Reserve Bank of St. Louis-Little Rock Branch. Membership is open to funders who invest in a range of initiatives that build assets for Arkansas, from early childhood education, college access, or workforce development to health, financial capacity, or micro-enterprise. Arkansas AFN members meet regularly and host events to share ideas. Learn more about the Arkansas chapter’s impact in AFN’s Power of Place publication.

Grantmakers investing in Arkansas should contact Abby Hughes Holsclaw if interested in joining this chapter.

Regional Focus Areas

Upcoming Events

October 30 @ 2:00 pm - 4:00 pm CDT : Bank On Arkansas+ Meeting

Join the Bank On Arkansas+ coalition for our final in-person convening of 2024, featuring the Financial Health Network, who will present new data from their … REGISTER

CLICK HERE for more information and resources from our past events.

Special Initiatives

Upcoming Events

Steering Committee

Winthrop Rockefeller Foundation

Southern Bancorp

Arkansas Access to Justice Foundation

United Way of Central Arkansas

Walton Family Foundation

Ross Foundation

Federal Reserve Bank of St. Louis

Excellerate Foundation

Women’s Foundation of Arkansas

HOPE

Baptist Health Foundation

Entergy Arkansas

Arkansas Community Foundation

Arkansas Community Foundation

Heart of Arkansas United Way

Blue & You Foundation for a Healthier Arkansas

Communities Unlimited

Women's Foundation of Arkansas

Arvest Bank

Chapter Highlights

A Look at the Wealth Gap in Arkansas and The Actions You Can Play for ALICE

On August 24, 2023, the AR Asset Funders Network hosted a briefing, A Look at the Wealth Gap in Arkansas & The Actions You Can Play for ALICE. Moderated by Karen Murrell , the event explored the Consumer Financial Protection Bureau debt findings for philanthropy, nonprofits, elected officials, and financial institutions. U.S. Consumer Financial Protection Bureau’s Desmond Brown and Diane Standaert and Arlo Washington of PEOPLE TRUST Community Loan Fund offered expertise and insight on how to remove barriers to wealth and mobility in Arkansas. Speakers showcased new information on consumer experiences in Arkansas, particularly in rural communities and communities of color. This event amplified the impact of medical debt, elevated trends and gaps in mortgage lending, and showcased opportunities to create transparency in small business lending. LEARN MORE.

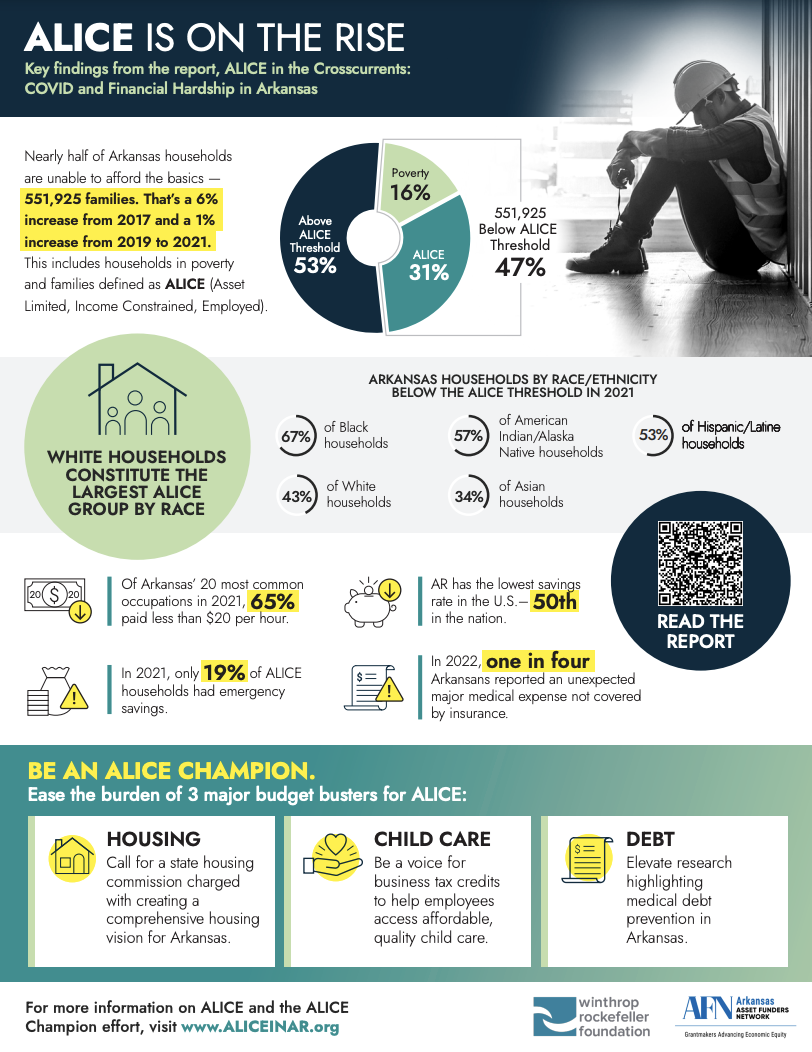

ALICE Champions Policy Conversation Summary

On January 24, 2023, Rev. Shantell Hinton Hill, senior equity officer with the Winthrop Rockefeller Foundation, kicked off the ALICE Champions Policy conversation at the ASU systems building in Little Rock, Arkansas. The event centered on asking policy, business, philanthropic, and nonprofit leaders to use their voice and influence with ALICE to impact systems and policy changes around three budget busters —medical debt, housing, and child care. LEARN MORE.

Arkansas Financial Education Commission

Helping Arkansans achieve financial well-being through education and networking, for now and for future generations. LEARN MORE

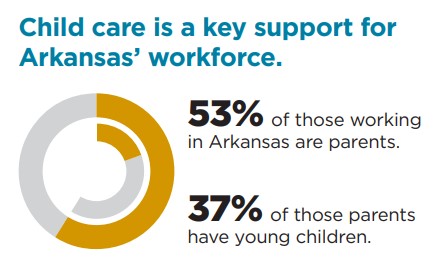

Roundtable to Highlight Early Care Needs for ALICE

On Wednesday, September 8, 2022, the AR Asset Funders Network partnered with Excel by Eight and the Institute for Economic Equity at the Federal Reserve Bank of St. Louis hosted a roundtable discussion ‘Child Care and the Economy: An Arkansas Roundtable.’ The gathering featured business and industry leaders from across the state who shared insights and discuss opportunities to support child care for the current and future workforce. LEARN MORE

Women Entrepreneurship Support Organizations Collaborative Meeting

On July 13, 2022, the initial meeting was held to form a Women’s ESO collaborative, hosted by the Women’s Foundation of Arkansas in partnership with the Arkansas Economic Development Commission, Arkansas Asset Funders Network, and the Venture Center. The purpose was to bring together organizations that provide support for women entrepreneurs and explore our shared interests to accelerate the growth of women owned businesses in Arkansas. LEARN MORE

Bank On Arkansas+ Celebrates 5 Years!

The Arkansas Asset Funders Network (Arkansas AFN) recently celebrated the fifth anniversary of Bank On Arkansas+ (BOA+), a statewide coalition providing secure, affordable, and certified banking options to empower Arkansans. Launched in 2018, BOA+ has grown into a statewide coalition with over fifty members, representing banks, credit unions, and community partners in all 75 Arkansas counties.

The event at Bank OZK Headquarters highlighted the program’s impact on the ALICE population and featured presentations and discussions on the future of financial empowerment in Arkansas. Forbes magazine ranked Arkansas as the fourth best state for banking access, acknowledging the substantial decrease in unbanked households since the initiative’s launch. The collaborative efforts behind BOA+ were commended by industry leaders, recognizing the initiative’s transformative impact on Arkansas’ unbanked population. As the coalition addresses challenges posed by the digital era, including the digital divide and access to capital, stakeholders express optimism about BOA+’s future and its potential for fostering greater financial inclusion statewide.

Bank On Arkansas+

Financial Inclusion for All Arkansans

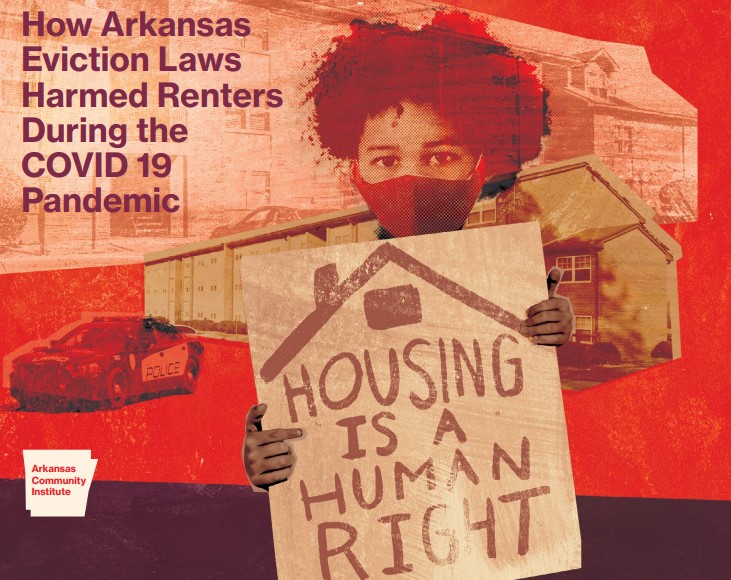

No Shelter in Place

How Arkansas Eviction Laws Harmed Renters During the COVID-19 Pandemic

Arkansas has some of the nation’s harshest eviction laws. Tenants who are even a day late on rent can be evicted. Arkansas Community Institute recently released a report that examines the impact of the COVID-19 pandemic on Arkansas renters. The report builds on work with tenants throughout the pandemic and includes an analysis of judicial evictions during the first two years of the pandemic.

A Conversation with Bill Bynum

On January 31, 2022, we were joined by Bill Bynum, Chief Executive Officer of HOPE and Anthony Young, Executive Director of Southern Bancorp Community Partners, for a conversation on supporting the financial health of families and small businesses during an ongoing pandemic. Watch the recording and for more information, contact Kara Wilkins at kara@assetfunders.org.

We’re Still Hurting! From the ER to the Courtroom: How Medical Bills and Court Costs Trap People in Debt Cycles

A January 2022 virtual gathering, moderated by Talk Business and Politics host Roby Brock, provided an overview of medical debt and court costs; described how debt cycles disproportionately harm lower income communities, ALICE households, and people of color; and elevated federal, state, and hospital-led policy recommendations that could help alleviate and prevent debt traps. It also highlighted how the court system, state legislature, and local governments could enact changes to end the criminalization of poverty and reform debt collection practices. LEARN MORE

More Articles on this topic:

- Arkansas Democrat-Gazette: Community groups pay off more than $35M in Arkansans’ medical debts, ponder more permanent solutions

- Arkansas Times : Medical debt relief provided for thousands of Arkansans

- KUAR: Arkansas groups erase millions in medical debt

ALICE IS ON THE RISE -Key findings from the report, ALICE in the Crosscurrents: COVID and Financial Hardship in Arkansas.

Key findings from the report, ALICE in the Crosscurrents: COVID and Financial Hardship in Arkansas.

Members are invited to share their new initiatives, stories, and highlights from the field.

How We Work

- Inform: Members learn from one another and stakeholders as they seek solutions to local challenges. The chapter hosts issue-based programming and calls-to-action that reflect research and philanthropic thought leadership that highlights actionable roles for philanthropy. While focusing on a variety of topics, the chapter gathers local leaders and national experts together to share data and ideas, promote innovative approaches, and help establish common language to build collaboration.

- Influence: Engage funders and public/private stakeholders in frank, issue-based discussions that influence policy and foster systemic change. Members seek opportunities to accelerate economic prosperity while also reducing racial, ethnic, and gender wealth gaps. Members provide an insightful Southern voice to inform national and local conversations on topics including access to capital for women of color, reduction of debt, financial coaching, Arkansas tax reform, and banking the unbanked.

- Connect: Members support peer-to-peer learning and cross-sector collaboration. Members identify and leverage replicable and scalable high-impact strategies and innovative approaches to connect and inform influential funders of actionable investments.

- Build: Work to increase the number of grantmakers and resources focused on strategies that help low and moderate income people build and protect assets. Members leverage one another’s interests and networks to actively identify additional funders willing to co-invest in the South.