We all assume that our nation’s civil courtrooms offer justice evenhandedly to plaintiffs and debt defendants alike. Yet, none of that is true in most courts across the country.

This brief is a call to action to reform the system. In it, we identify a set of reforms and promising practices, describe pathways to make needed changes happen, and highlight the role funders can play in promoting equity and restoring justice.

Ruthless debt collection—regardless of whether the debt itself is just or unjust, or even whether or not it is written off by the original creditor—is not a new phenomenon.

It blocks opportunity to generate wealth for under resourced populations, plunders wealth from communities of color, and contributes to the racial wealth gap. Profiteering debt collectors have designed schemes to take advantage of state and local court systems and stack new debt (interest, costs, and fees) on top of old debt—often on debts the original creditors have already written off. The scheme depends heavily on high-volume filings and default judgments, which are granted when the defendant debtor is not present in court, to produce binding orders based on debts that may be invalid or, often, directed against people who are not the real debtors.

Debt collectors then report these judgments to credit bureaus, creating a negative mark on the debtor’s credit record and reducing his or her credit score. Black, Indigenous, Latinx and other people of color disproportionately experience the array of harmful effects from such judgments and the resulting reports to credit bureaus.

The publicly funded courts also provide the debt collector with tools to intercept paychecks, wipe out bank accounts, and otherwise seize assets of the debtor. As a result, the business of debt collection through the courts exacerbates the racial wealth divide.

Consumer Debt in Collection

Consumer debt includes medical bills, fines and fees, private student loans, credit cards, utility bills, car loans, and other unsecured debt.

Consumer debt is an important tool that can help build or protect assets and wealth by enabling investments in business start-ups, education or skills training, and home improvements. Yet, the advantages of access to helpful credit have not been available to all. Policies and practices such as race-based redlining, undermined the ability of people of color to build wealth through homeownership and created unequal credit markets based on that lack of wealth. These discriminatory laws, policies, and practices became self-perpetuating racialized realities about who can access affordable credit and who represents a greater risk to a creditor. The persistent result is higher interest rates or more predatory terms for consumer credit for communities of color. Other factors contributing to the widespread inability of consumers to cope with financial shocks include wage stagnation beginning in the 1970s, the move towards jobs with greatly increased income volatility, rapidly rising housing costs since the 1960s, and spiraling childcare costs.

The COVID pandemic has sharply highlighted, and widened, racial inequities. Black, Indigenous, Latinx, Asian, Pacific Islander and other people of mixed race have been disproportionately more exposed to job loss, death or medical incapacity of family wage-earners, and COVID-related debt such as medical bills, credit card debt to pay rent and essential costs, and unpaid rent or mortgages or other bills.

Debt Collectors and Debt Buyers Profiting from Inequity and Hardship

Debt collectors, especially corporate debt buyers, are companies that exist to profit from individuals who cannot pay their bills. Credit card companies, hospitals, and utility companies usually have an inventory of overdue debts. Some have in-house debt collection units, but most companies eventually write off the debt while also seeking to gain some revenue from it.

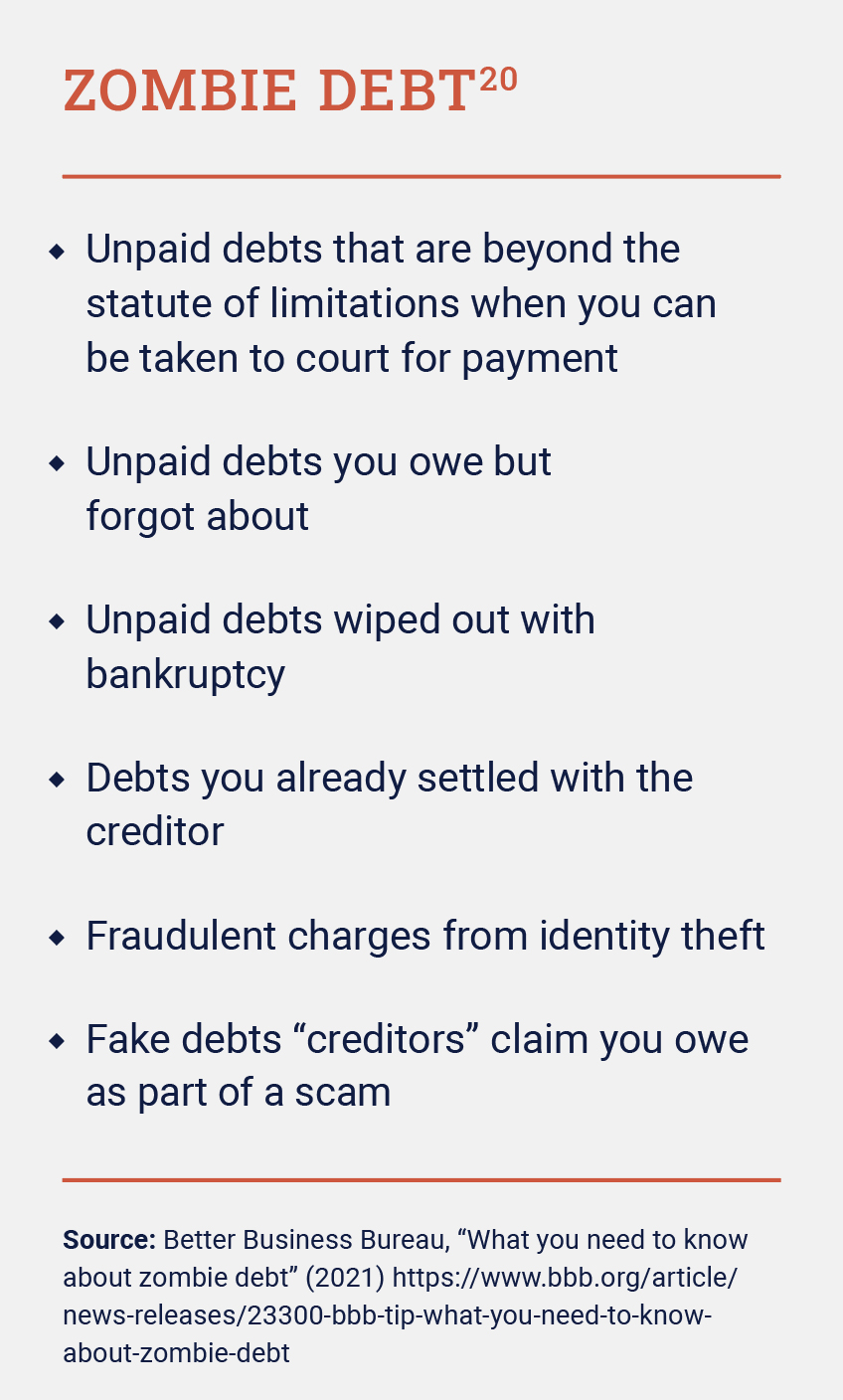

These companies aggressively pursue collection of the original amount of the debt through the courts, usually tacking on additional interest, court costs, and attorneys’ fees. The top complaint among consumers in debt collection is continued attempts to collect debts that either have been paid or were not their debts in the first place. Debt buyers have proliferated since 1993; the value of debts bought by debt buyers increased from $10 billion in 1993 to $98 billion in 2013.19 That growth is driven by the profitability of using the courts and unbalancing the justice system to collect debts; “zombie debts” are at the heart of a highly lucrative business model.

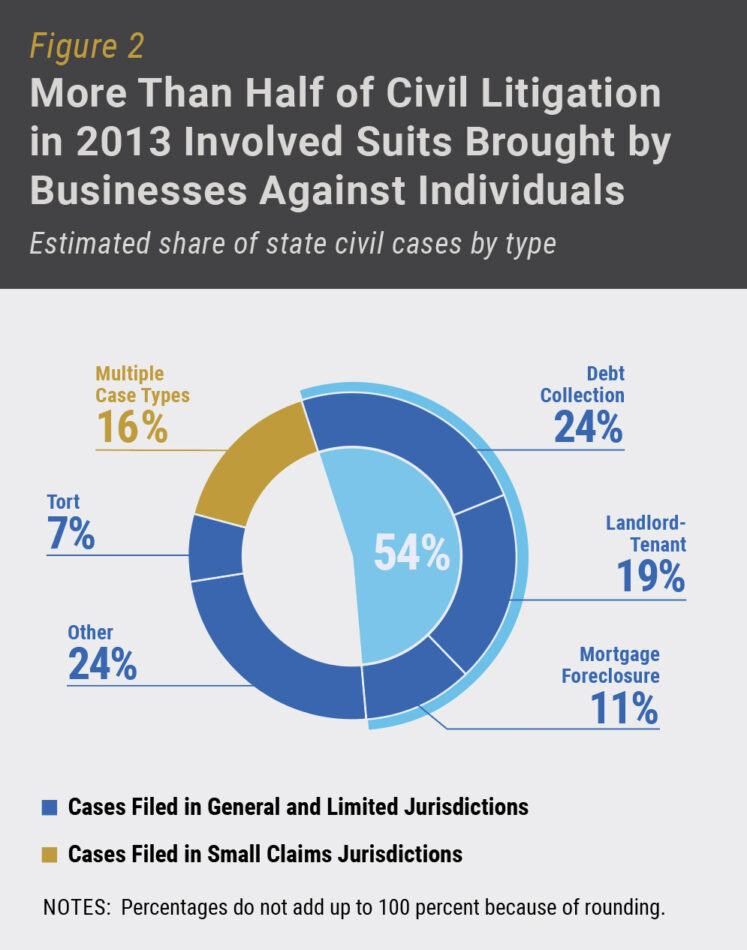

The small-claims and civil court systems and their processes are ideally suited for debt-collection corporations to maximize profit regardless of the justice of the outcomes. The numbers of debt collection cases have increased dramatically. Between 1993 and 2013, the number of cases more than doubled, from 1.7 million to 4 million. As a result of these trends, debt collections cases now account for one in four cases on the civil docket, up from one in nine.

the off-balance justice system and the 6 areas for systemic change

The off-balance justice system relies on a number of tactics and procedural approaches; understanding how debt collectors manipulate the system highlights areas where systemic change is needed

UNRELIABLE ALLEGED FACTS AND ROBO-SIGNING OF COMPLAINTS

LACK OF MEANINGFUL NOTICE

DEFAULT JUDGMENTS ISSUED WITHOUT REVIEW OF THE UNDERLYING EVIDENCE

DIFFICULTY REOPENING CASES

PUBLICLY FACILITATED COLLECTIONS AND WEALTH STRIPPING

A MODERN RISK OF DEBTORS’ PRISON

The Results Change When the System is in Balance

The assumption that this system produces justice collapses in an environment built on default judgments, in which only one side has all the information plus the advantage of being unopposed in court. That side invokes the power of the court without having to prove anything.

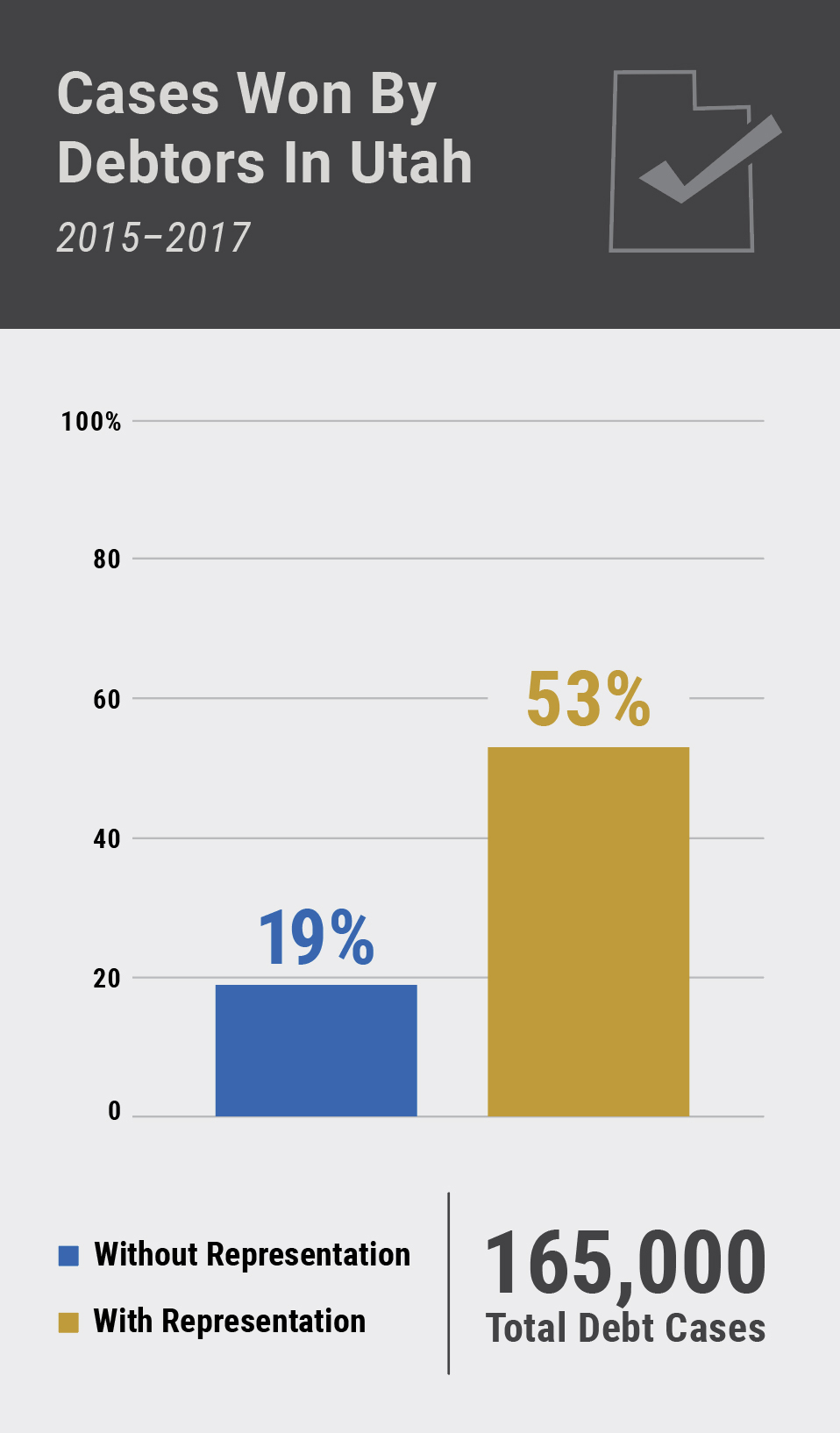

Debtors who have lawyers win much more often; thus, the debt collectors’ business practice is to concede when the other side has a lawyer. The logic is that the claim is not likely to succeed and, therefore, arguing it is not a cost-effective use of time and resources. In other words, legal representation can be a key difference maker.

The disparate racial outcomes that prevail throughout the consumer debt landscape also appear with respect to court cases and default judgments. While it is still unclear what the effect of the COVID-19 pandemic has been or will be on consumer debt in general, it is quite clear that court filings, wage garnishments, and other collection tactics are proceeding unabated during the crisis.40 Catastrophic impacts are looming and require that balanced justice be restored.

An Agenda for Reform

The massive amount of consumer debt is the product of many years of racially inequitable lending, fines and fees, health care bills, and other practices, compounded by collection practices that worsen and sustain racial wealth gaps, and the potential for significant COVID related debt.

FEDERAL CONTEXT AND POTENTIAL REFORMS

Federal policies set the floor for national standards; states can establish standards above that floor.

Philanthropy can support research and analysis in this area, as well as advocacy to promote action by CFPB, Congress, and the DOJ regarding these racial disparities.

STATE AND LOCAL REFORMS

State and local policy changes are more likely to occur within a shorter time horizon than federal changes. The needed reforms may require action by state legislators or the court system itself. Philanthropy can help test innovation; fund research; support advocacy and narrative change efforts; exert influence with the bar associations, as well as creditor groups like hospitals and credit card companies; and inform and influence decision-makers.

funder Recommendations

Several types of innovations and reforms may help restore balanced justice.

-

Make legal representation more accessible

-

Reform court processes, policies, rules, and procedures

-

Fund judiciary capacity to produce data on dockets and outcomes

-

Protect more income and assets from judgment creditors

Conclusion

For each set of systemic reforms proposed here, philanthropy is needed to shift the system, restore balance, and promote greater economic stability.

This brief is an ambitious call to action. Accomplishing reform will require many layers of activity, including advocacy at the federal, state, and local levels and at all three branches of government. Change involves increasing legal representation, experimenting with pilot programs, collecting and monitoring data, engaging in research and support for implementation, and ensuring ongoing monitoring and constant improvement. Because they can be relatively flexible in what and how they fund, grantmakers can play a unique role in boosting access to justice and accountability and beginning to mitigate the racial wealth inequities embedded in this system.

Support for this publication was generously provided by: