A thriving economy—with plenty of jobs and secure retirement—requires vocational, two, and four year college graduates ready to work. Families save for college, despite financial barriers, if it’s relevant to their lives, and if they can access the right incentives and tools. The process must start early, with savings vehicles that reinforce a belief that children are, indeed, college bound.

Beyond savings, families need access to scholarships, “Promise” programs, and support for college completion. Less debt can be a game-changer for a recent grad. Over three-quarters of college graduates without loans have a positive net worth by age 26, compared to one-third of graduates with loans. AFN gathers strategies that help secure the college opportunity for all, then shares them with our members.

Explore Education

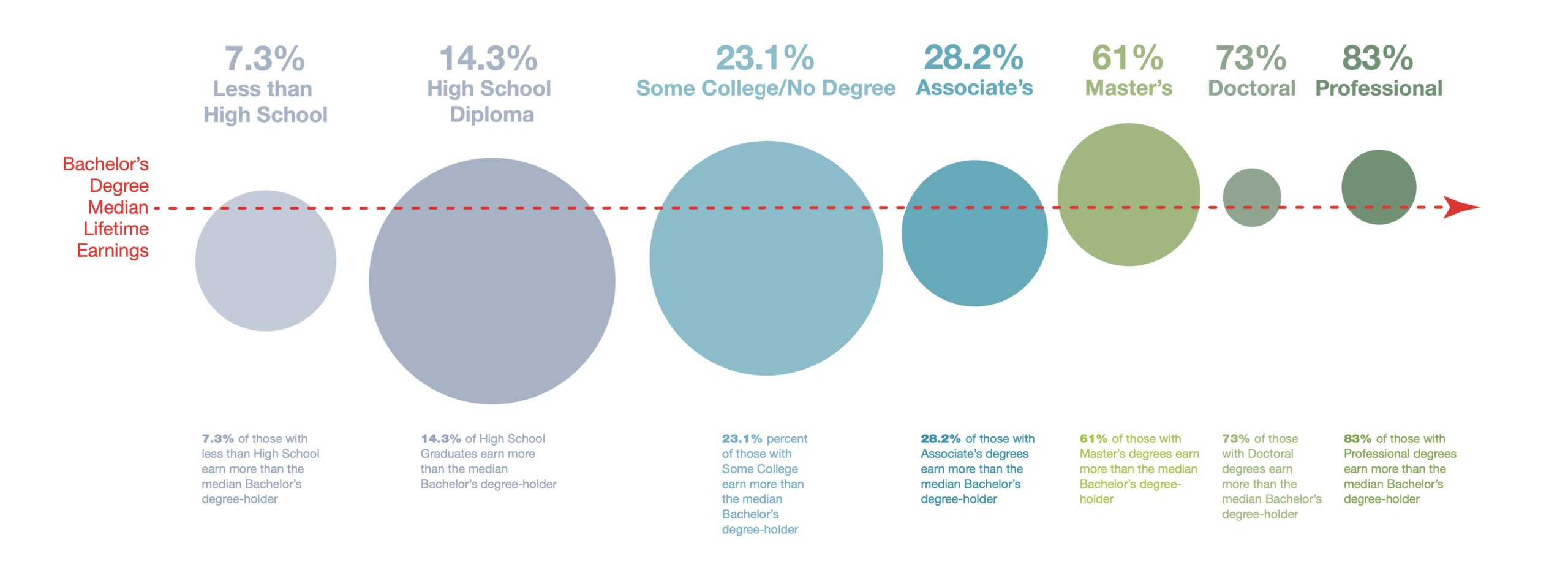

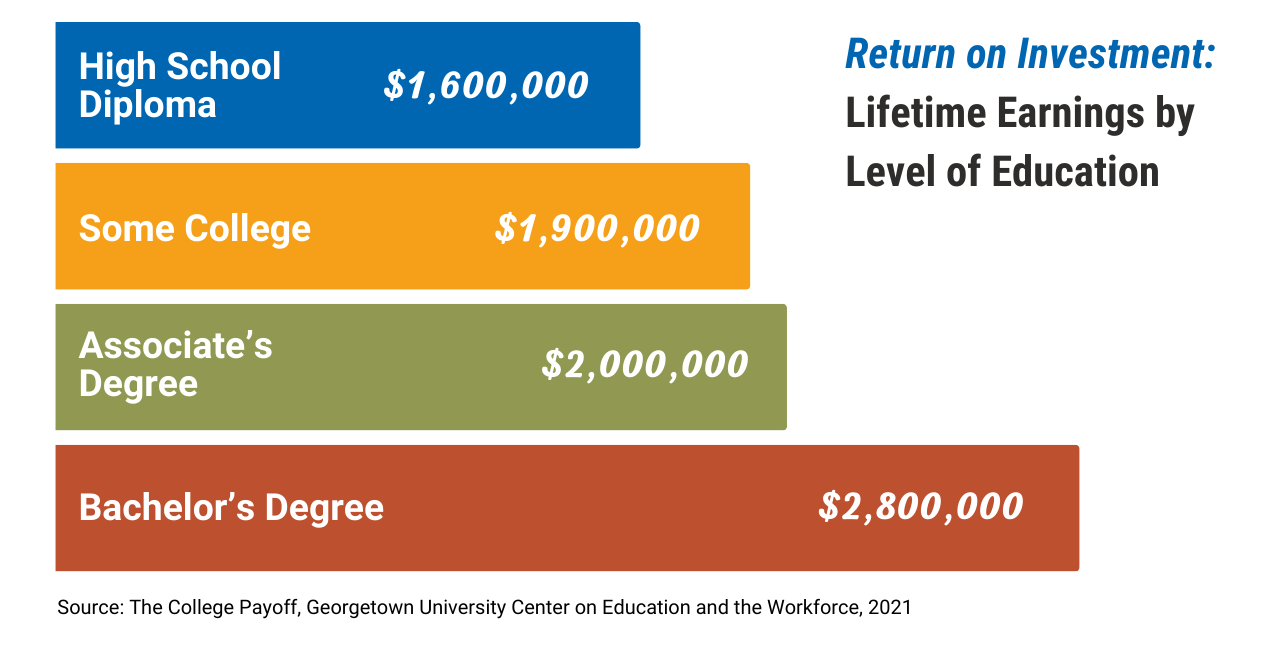

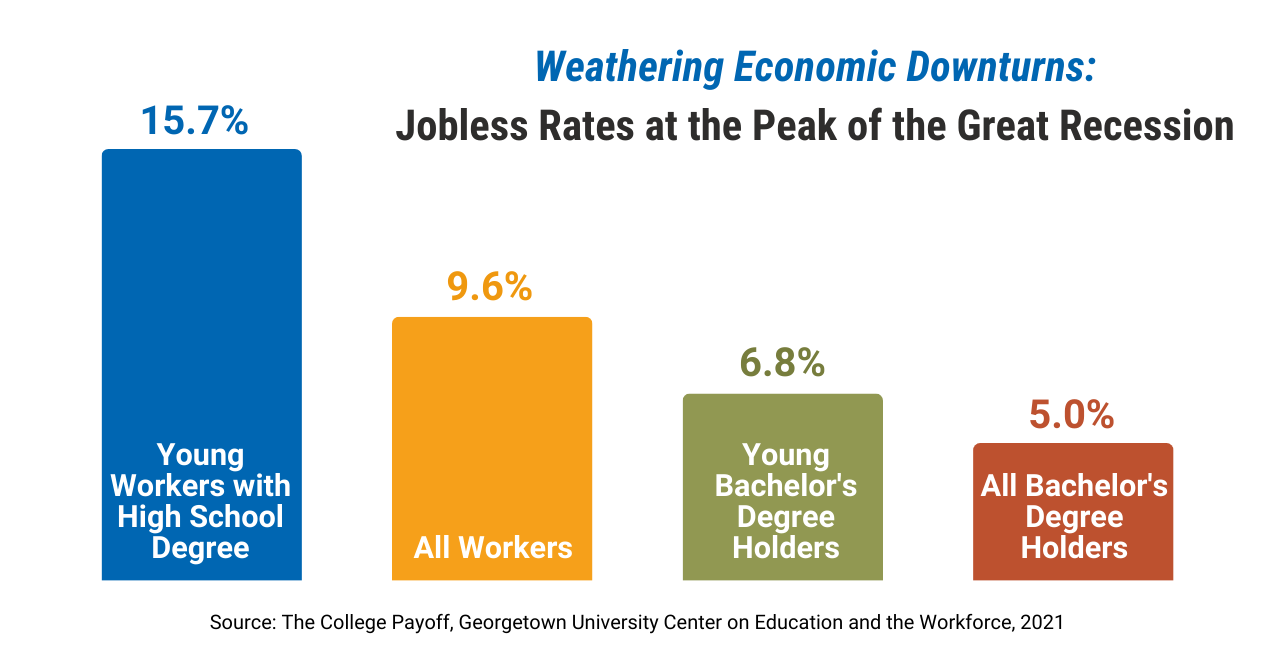

Earning a degree makes a difference, with lifetime earnings varying significantly and increasing the ability to weather an economic downturn.

Higher income means more disposable income, allowing for asset building.

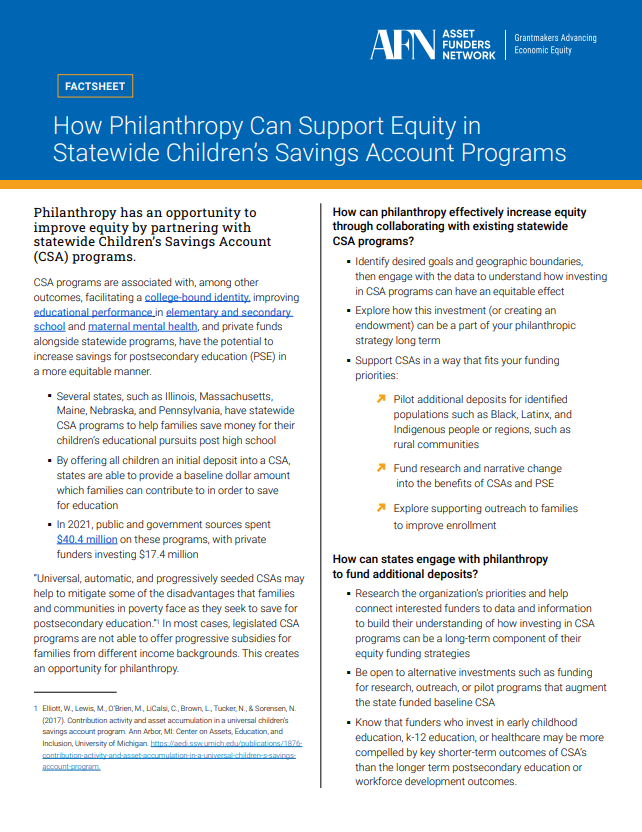

Children’s Saving Accounts—an effective tool to create future orientation and college aspirations for every child

AFN’s Children’s Saving Accounts: A Primer is the perfect launching off point for learning about this impactful asset-building tool.

Each time a consumer’s student debt-to-income ratio increases by 1%, their consumption declines by 3.7%, according to the Education Data Initiative.

Each time a consumer’s student debt-to-income ratio increases by 1%, their consumption declines by 3.7%, according to the Education Data Initiative.

Learn more about student debt and how philanthropy can intervene in AFN’s brief: Majoring in Debt: Why Student Loan Debt is Growing the Racial Wealth Gap and How Philanthropy Can Help.

AFN Publications on Post-Secondary Education

Why It’s Important

Funder investments that focus on supporting college completion for a broader array of students will increase opportunity and equity.

Increased college enrollment rates

Higher college graduation rates

More college graduates among low income children and children of color

Less debt for college graduates

More college graduates with a positive net worth

More workers trained with relevant skills and ready to succeed in the future workforce

Grantmaking Strategies

Over the life course, having a technical or college education matters more than ever for good jobs, financial stability, and asset building. That’s why more grantmakers are finding ways to support efforts to bud aspirations, broaden saving experiences, and expand the opportunity pipeline for graduation from post-secondary vocational, two, and four year colleges and to reduce, if not eliminate, destabilizing student debt.

Strategies addressing the aspiration, application (college and FAFSA), and debt hurdles will help to improve economic stability for future generations. Funder investments that focus on supporting college completion for a broader array of students will increase opportunity and racial/ethnic equity. Managing the financial burden of student debt will help to ensure better economic stability and prosperity for future generations.

Grantmakers are increasing investments in Children’s Savings Accounts (CSAs). CSAs, established early in life, provide the vehicle and incentives to help families and communities build a post-secondary identity for the child that is future oriented and builds hope for the future with a plan to attend college. Indeed, some community foundations are using CSAs as a vehicle for early distribution of scholarship funds. The full effects of CSA are still being studied, but the research is very promising across programs in rural and urban areas.

Grantmakers across the nation also invest in Promise challenges, equity promoting scholarships, college preparation and completion support. The goal includes building a more inclusive higher education pipeline. These are funded in rural counties as well as growing numbers of urban schools and districts.

Equity goals, in particular, depend on college completion with manageable debt. But destabilizing student debt is rising. If not proactively addressed, this debt burden will exacerbate gender and racial wealth gaps. Grantmakers are paying attention to education debt and the economic instability it contributes to, even for those with “good” jobs. Younger workers with high student loan debt delay buying their first home, often have poor credit ratings, and experience serious negative mental and physical health effects to the debt burden.

In the near future, philanthropic leadership, of necessity, will support rebuilding the economy after the pandemic. Through investing in education by growing and linking all of these education focused asset building related strategies, both in urban and rural communities, philanthropy will help show the way to grow economic stability and prosperity.

CONTACT: Christi Baker, christi@assetfunders.org

““Historically, we know that debt directly correlates to degree completion. It’s no surprise that by decreasing college debt, we increase both college success and the long-term financial health of our scholars.”

– Kevin Almasy | Dell Scholars Retention & Alumni