The field of financial coaching has continued to advance over the last decade with increasing support as a means to bring positive financial change to individuals and families. With a growing body of research and evidence backing the success of coaching, as well as an expanding community of funders, researchers, organizations, and practitioners committed to the development of the field, the progress of financial coaching has been a dynamic collective effort. In view of this increasing size and evolving scope of the field, endeavors to continually evaluate this shifting landscape are imperative for the fidelity, strength, and momentum of the practice of financial coaching.

Financial coaching has gained recognition as a strategy that can improve financial capability and security. Over the past decade, financial coaching has moved from concept to reality. Yet within this advancing field of practice, many questions remain. What is the current size of the field? How is financial coaching being implemented? How do organizations, coaches, and funders measure success? And what is needed to support more effective implementation?

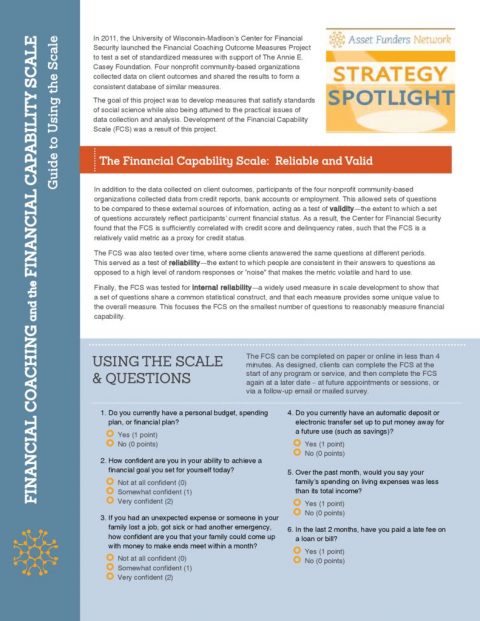

To begin to address these questions and support the growth of the financial coaching field, the Center for Financial Security (CFS) and Asset Funders Network (AFN), with support from The Annie E. Casey Foundation, developed these resource materials: a brief, a webinar, and a presentation, entitled Financial Coaching Census 2016.

The goal of these resources is to better understand the financial coaching field, from its size to its scope, identifying both challenges and opportunities.

Resource Sponsors

These resources were sponsored by the following: The Annie E. Casey Foundation, J.P. Morgan Chase & Co, MetLife Foundation, United Way, and Wells Fargo.