Read excerpts from the brief below!

Signs of financial stress among US workers are all around us:

- Nearly half of employees lack emergency savings, and find it difficult to cover their expenses and pay their bills.

- More than 50% of employees say they are somewhat or very stressed about their finances.

- One third of employees say they are less productive at work because of their financial stress.

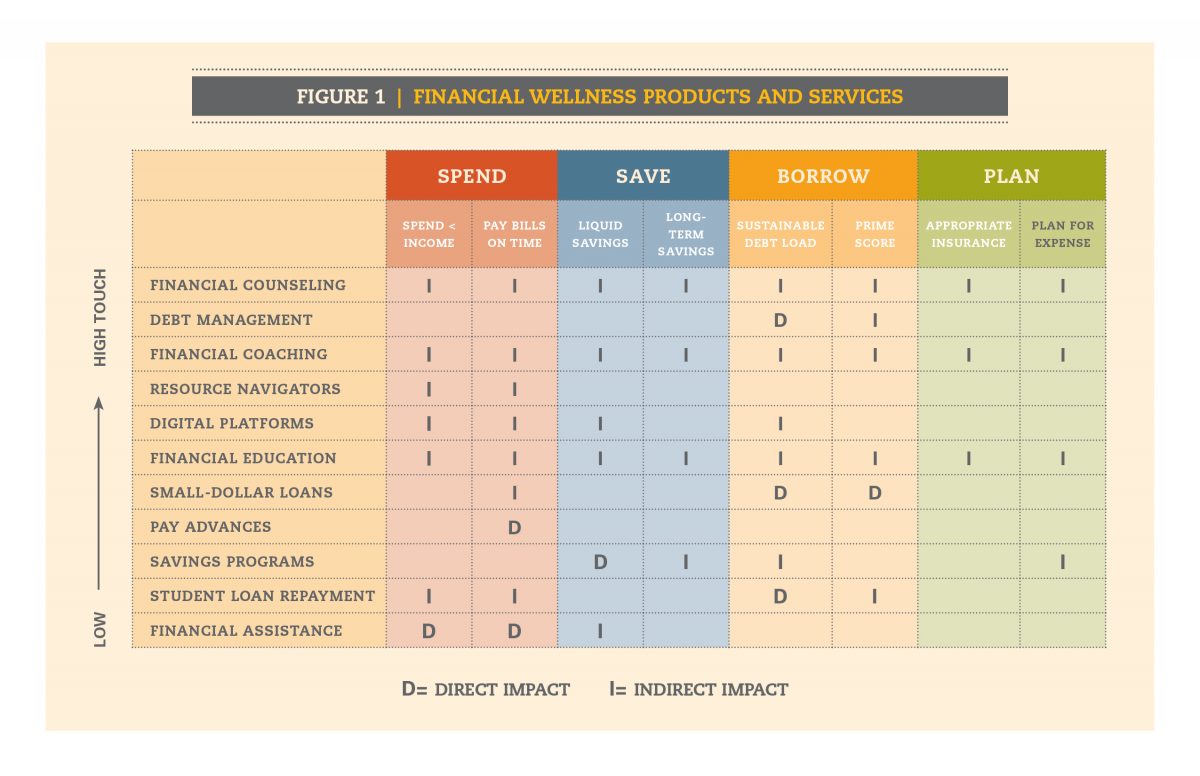

This report, When A Job Is Not Enough: Employee Financial Wellness and the Role of Philanthropy, sheds light on the role employers and philanthropy can play in best promoting financial well-being for workers through the offering of Employee Financial Wellness Programs (EFWPs). Data suggests that EFWPs improve employees financial stability and help create a more productive work environment.

There is real opportunity for Philanthropy to partner with employers and offer financial coaching and small-dollar credit products to help address the challenges that cause financial stress amongst employees. EFWPs open the door for philanthropy to impact financial security in a potentially scalable way, especially among economically vulnerable workers and their families.

Learn:

- The most promising features and challenges of Employee Financial Wellness Programs (EFWPs);

- What we need to know about the opportunity of EFWPs to address financial security for employees;

- The role of philanthropy in promoting EFWPs.

Webinar

Now available: webinar recording from September 26, 2019 AFN’s presentation of When A Job Is Not Enough: Employee Financial Wellness and the Role of Philanthropy, with report author Mathieu Despard, MSW, Ph.D, Faculty Director, Social Policy Institute at Washington University in St. Louis, Marissa Guananja, Program Officer for Family Economic Security at the W.K. Kellogg Foundation, Kim Ostrowski, Vice President, Corporate Giving, Prudential, and moderator Jeanique Riche-Druses, Vice President, Relationship Manager Global Philanthropy, JPMorgan Chase & Co.

EXCERPTS FROM THE BRIEF

Estimates concerning participation rates in employee financial wellness programs range from 31% to 65% while other studies suggest strong interest in them among employees:

- 86% of employees are somewhat or very likely to participate in an employee financial wellness program if offered.

- 92% of young employees (age 22-33) with student debt would use an employer match for loan repayments if offered.

- 79% of young employees (ages 22-33) with student debt would use a student loan debt counselor if offered.

- 71% of employees said they would somewhat or very likely use a “rainy day” savings program with payroll deduction if offered by their employer.

Catalytic Funding to Build and Grow New Programs Start-Up Funding

In addition to direct funding for employee financial wellness programs as outlined above, philanthropy can leverage financial resources in other ways. Philanthropy could provide start-up funding to build new programs and/or patient capital to invest in innovative models that grow those programs. Within the field of employee financial wellness programs, this catalytic funding might also include developing business models that could generate revenue for supporting nonprofits or allow for new technology platforms that require upfront investment. For example:

- The nonprofit organization, Neighborhood Trust Financial Partners, received support from several funders to launch its social enterprise Trusted Advisor, a workplace financial counseling service that has been offered to several mostly small- and medium-size employers using both in-person and digital service delivery.

- The 2019 Workplace Financial Health Challenge of the Financial Solutions Lab, which is managed by the Financial Health Network49 with founding partner JPMorgan

Chase & Co., provides funding and technical assistance to nonprofit and for-profit employee financial wellness program providers to help strengthen and scale up a range of digital solutions that address savings, medical debt, 401k transfers, and employer-sponsored smalldollar loans.

Philanthropic start-up funding takes into account that such investments are often exploratory and unproven, require a multiyear commitment, and require flexibility of the funder to change course as experimentation yields programmatic insights. Investments could be in the form of grants or program-related investments. These investments may be advantageous if the employee financial wellness program provider needs more capital than would ordinarily be available through grant budgets and cycles, and the provider has a sound business plan for selling its program to employers.