Despite a 114% Growth Rate, Women-Owned Businesses, Do Not Generate Same Wealth As Male-Owned Businesses

– Limit to Capital and Occupational Segregation are Key Obstacles –

A new report produced by Asset Funders Network (ANF), in collaboration with Duke University’s Samuel DuBois Cook Center on Social Equity and Closing the Women’s Wealth Gap (CWWG), reveals that while data shows women-owned businesses are growing in number, the businesses are typically smaller in size and generate lower revenues and profits for their owners and employees.

The report, Unlocking Assets: Building Women’s Wealth Through Business Ownership, is the third in a series that builds off AFN’s original 2015 publication, Women & Wealth, which explores how the gender wealth gap impacts women.

Why the focus on women business owners?

Nationwide, households are increasingly reliant on women’s earnings—in 2015, nearly two out of three mothers in the U.S. were their family’s sole, primary, or co-breadwinners, contributing at least 25% of household income. The increasing relevance of women to the long-term financial security of American families is both an opportunity and a challenge for women responsible for their household’s financial security.

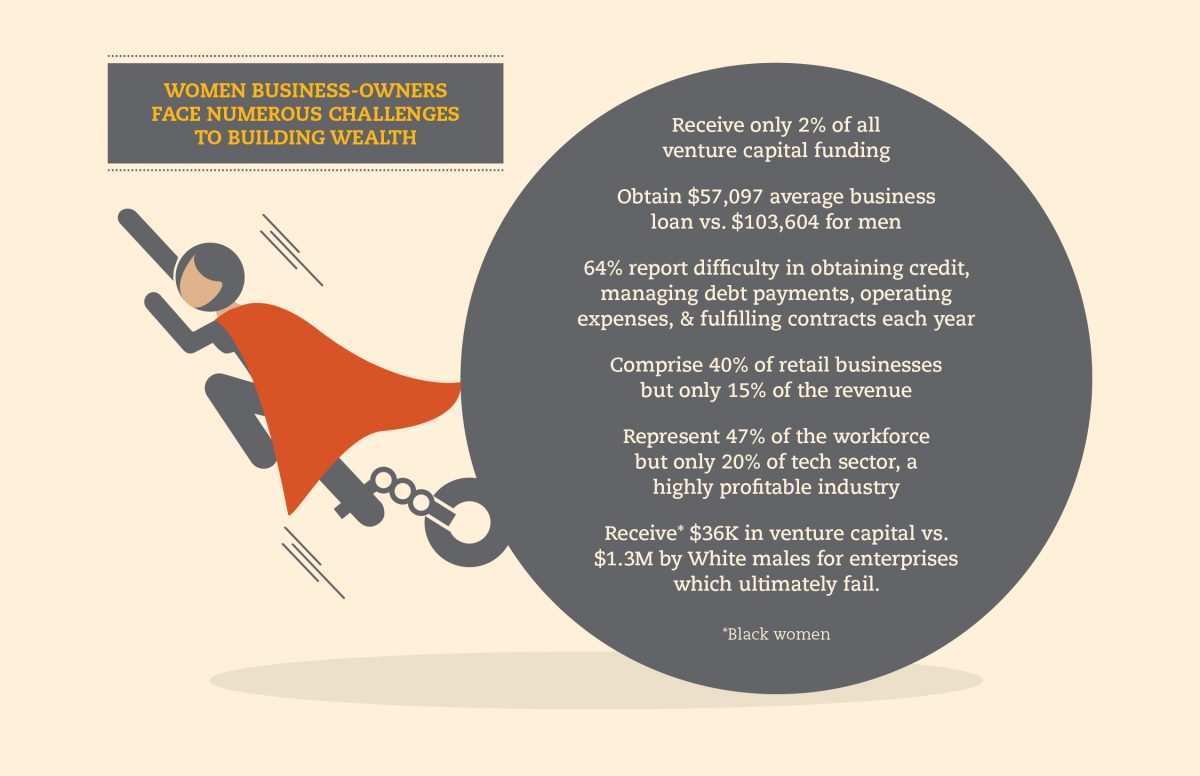

While business ownership serves as a wealth-building tool for women, the current prevalence of gender disparities in wealth, often the result of systemic drivers, remains a central challenge facing women across the country. The new report outlines the underperformance of women-owned businesses are due to key challenges:

- Constrained access to business financing, including loans and equity investments

- Lower levels of approved business financing

- Initial lower levels of overall wealth, particularly for women of color

- Less cash to start which limits the types and scale of businesses women own

- Occupational segregation, which limits the sectors within which women are starting businesses

- Limited access to mentors, business networks, and markets

- Lack of access to business education and training

Unlocking Assets describes the gender wealth gap, surveys prior research on the relationship between business ownership and wealth, highlights differences in both the number and performance of women-owned businesses compared to those owned by men, and outlines key challenges preventing more women-owned businesses from producing wealth for their owners.

“The data in Unlocking Assets shines a bright light on the barriers faced by women, especially women of color, related to starting and growing wealth-building enterprises,” said Joseph A. Antolín, AFN Executive Director. “Because of these barriers, women business owners are currently prevented from achieving economic security and reaching their full potential. Unlocking Assets provides demonstrated solutions that reveal we can make a difference.”

Despite the rapid growth in women’s business ownership in recent decades, a substantial gender gap persists in business performance when measured by survival rates, profits, employment, and annual sales revenue.

The rate of growth of women-owned businesses in the U.S., especially those owned by women of color, is often cited as a cause for optimism…as it should be,” said Heather McCulloch, Founder and Executive Director, Closing the Women’s Wealth Gap Initiative. “But what we don’t often hear is that those same businesses are not building wealth for their owners. Unlocking Assets explores systemic barriers facing women entrepreneurs and entrepreneurs of color as they try to build and grow their businesses; and it lifts up promising solutions – innovative programs, products and policies – that can help to break down those barriers in the years ahead.”

Unlocking Assets elevates and lays out the strategies and successful practices of strategically influential and innovative programs and investments, addressing the key challenges that impact women’s ability to start and grow wealth-building businesses

The financial security and overall well-being of families increasingly rests on the shoulders of women. As such, long-term economic security for women and their families requires that women have access not only to higher incomes, but also to wealth-building opportunities.

Unlocking Assets makes the case that for business ownership to serve as an effective pathway to wealth accumulation for women, as opposed to an employment strategy, core obstacles—limited access to capital, mentors and networks, business education and training, along with occupational segregation—must be addressed.

The Asset Funders Network (AFN) is a membership organization of national, regional, and community-based foundations and grantmakers strategic about using philanthropy to promote economic opportunity and financial security for low- and moderate-income Americans. AFN works to increase the capacity of its members to effectively promote economic security by supporting efforts that help low- to moderate-income individuals and families build and protect assets. Through knowledge sharing, AFN empowers foundations and grantmakers to leverage their resources to make more effective and strategic funding decisions, allowing each dollar invested to have greater impact.

Closing the Women’s Wealth Gap is a national network of more than 400 philanthropic, nonprofit, private, and public-sector leaders who are leveraging their collective knowledge, expertise, and networks to advance promising solutions that build wealth for low-income women, women of color, LGBTQ and other economically vulnerable populations.