To achieve economic security and mobility, families need both income and assets. While income helps cover basic expenses, assets can be leveraged to access potentially transformative opportunities like post-secondary education, home ownership, and business initiatives, and to weather financial crises like job loss.

However, nearly half of Americans do not have even $400 in savings for an emergency, let alone savings for college or a home. This deficit is made worse by the fact that most policies designed to help households accumulate capital currently favor families that are already wealthy.

Policymakers are increasingly recognizing this problem and taking action to give more families the chance to achieve financial stability through asset accumulation. One way policymakers are creating an “inclusive platform for lifelong savings and investment” is through Children’s Savings Accounts.

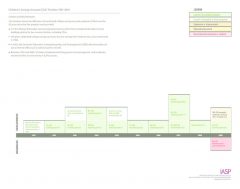

While this primary resource reviews the need for Children’s Savings Accounts, the secondary external resource, also from IASP, is a valuable resource that explores the timeline of Children’s Savings Accounts. Review it to see an almost 20 year examination of the key moments in the life of Children’s Savings Accounts programs.