It is important for funders to focus on debt as a strategy to address the racial wealth gap because systemic issues like historical discrimination in housing, employment, and education have significantly contributed to the gap. Practices such as redlining have restricted access to homeownership for communities of color, hindering generational wealth accumulation.

It’s important to acknowledge that the burden of debt is not evenly distributed, with notable disparities along racial and ethnic lines. The Aspen Institute highlights significant differences in the amount, characteristics, and composition of debt that contribute to or worsen adverse outcomes for people of color.

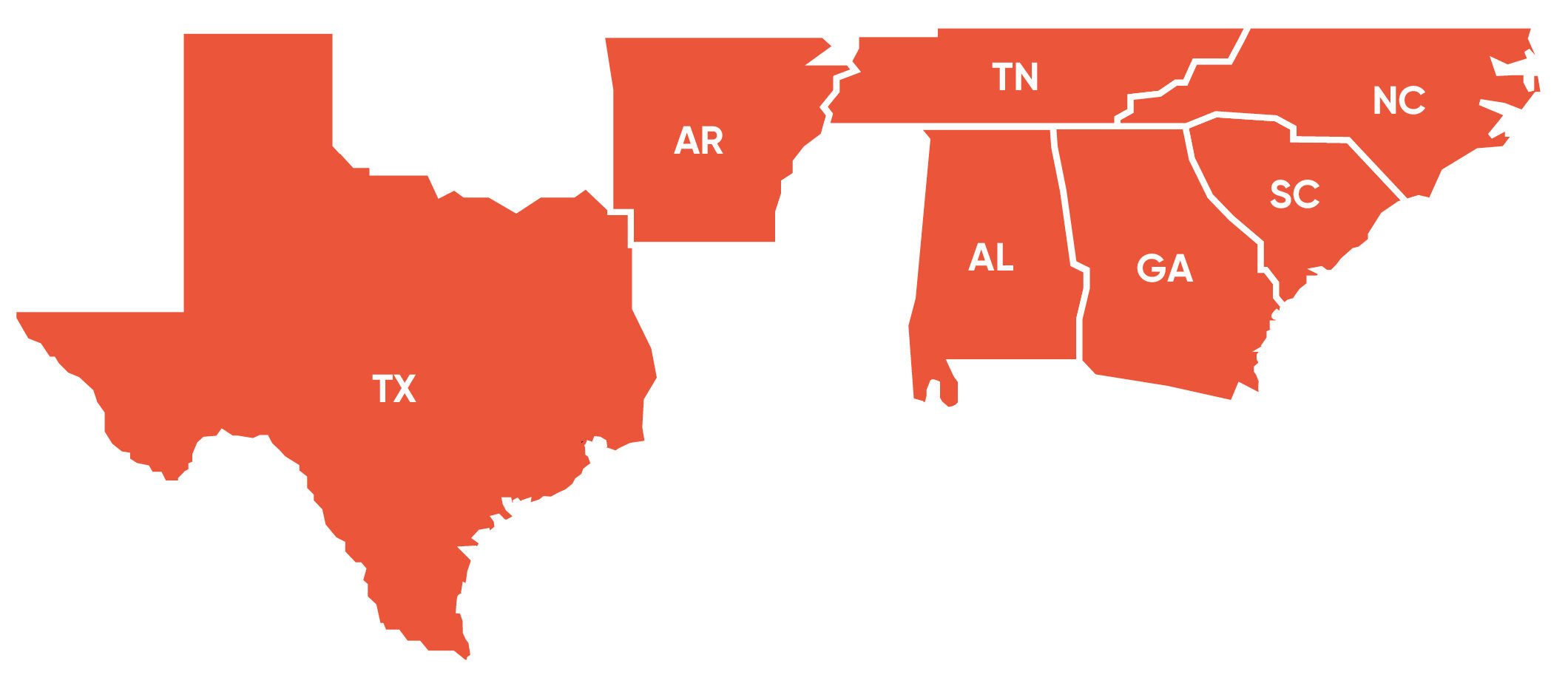

The impact of debt also varies significantly between the South and the rest of the nation.

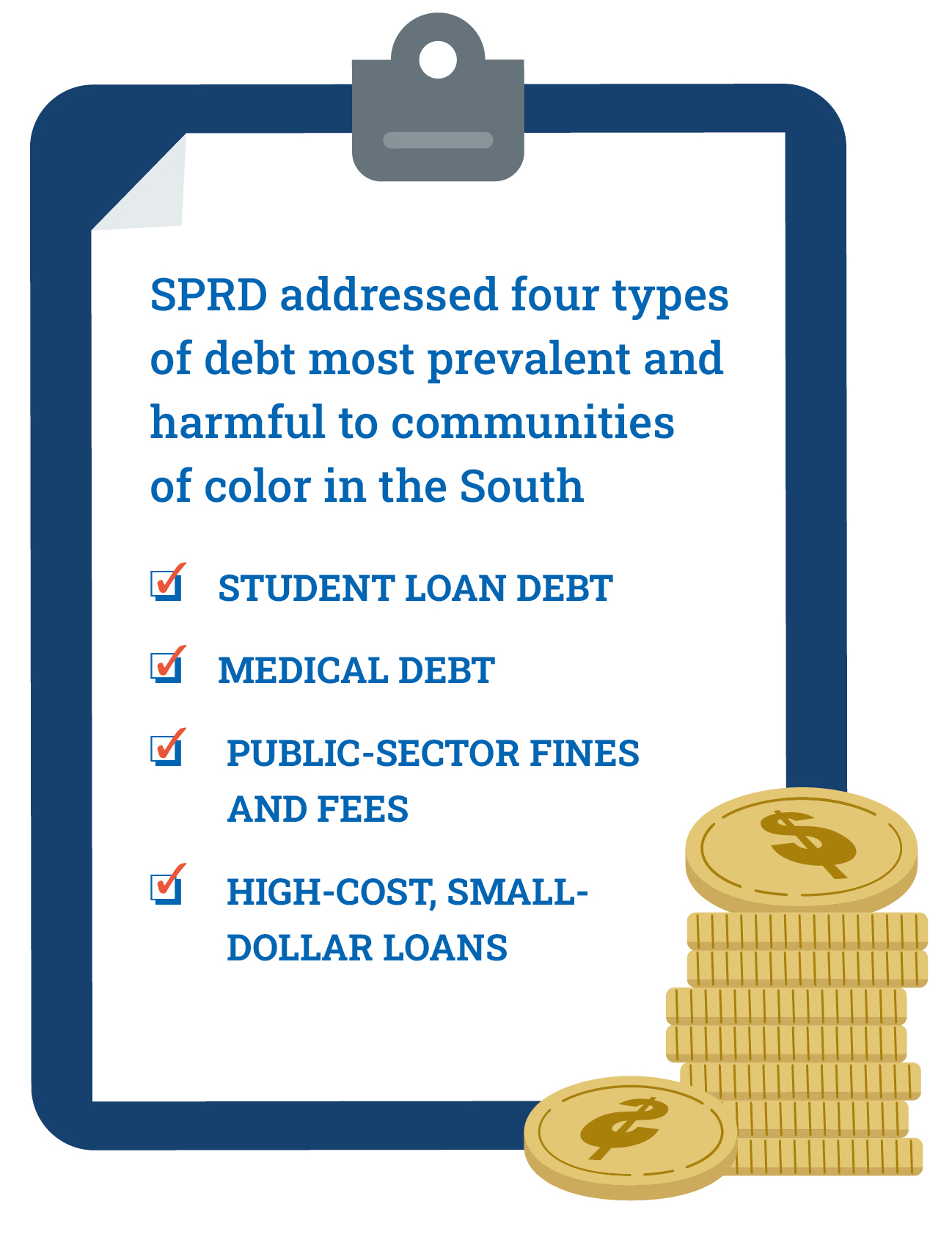

The Annie E. Casey Foundation conducted data analyses confirming that debt hinders financial well-being in the South and perpetuates the racial wealth gap. Ultimately, the Foundation launched SPRD, an initiative aimed at preventing and eliminating debt through programmatic and policy interventions. The initiative’s objective is to reform policies contributing to debt and to elevate the issue of debt in discussions about asset building and financial security.

The SPRD initiative also included national partners, who supported SPRD state partners by offering expertise and perspective in policy analysis, data platforms, communications, coalition building, and racial equity resources. These partners were selected to influence the national conversation on debt reduction strategies rather than work on federal policy.

To fully grasp the results and outcomes of SPRD, it is important to understand the context in which state partners operate. In many states, implementing changes in practices and policies to address harmful debt can be challenging. Political power dynamics in Southern states are often dominated by entrenched interests, such as powerful corporations, industry groups, and wealthy individuals, who may resist policy changes perceived as detrimental to their interests. Despite these formidable challenges, SPRD partners made significant progress in alleviating burdensome debt across all four debt types and in all seven states.