In this moment, it is pivotal for philanthropy to support communities of color in achieving financial well-being. Combined with systems-change efforts that would create fairer economic opportunities and conditions, financial coaching is a vital component of providing needed support. Through background information, case stories, and key investment considerations, this brief focuses on financial coaching with a racial equity lens as an important strategy for helping people of color achieve equitable outcomes.

Why Adopt a Racial Equity Lens Approach?

The effects of racism matter. Even when taking into account factors that are typically associated with better financial outcomes (i.e., two-parent household, working full time, reduced spending), Black and Latinx people lag behind in terms of wealth.18 Research makes clear that this gap is due to the disparate opportunities and access that are the products of systemic racism, rather than solely individual behaviors. An approach to financial coaching that fails to take this context into account will fail to address clients’ specific challenges.

Wouldn’t a colorblind approach be better?

Good coaching is good coaching, right?

Claiming not to see or minimizing racial inequities does not make them go away; acknowledging that people of different backgrounds face different challenges allows coaching programs to meet specific needs across racial groups. Research has found that people who claim to be colorblind are actually perceived by others to be more biased.19 Therefore, taking a colorblind approach is not an effective strategy to improve intergroup interactions or to mitigate disparate outcomes.

A disproportionate number of the people we coach are Black, Latinx, and Indigenous, so aren’t we already applying a racial equity lens?

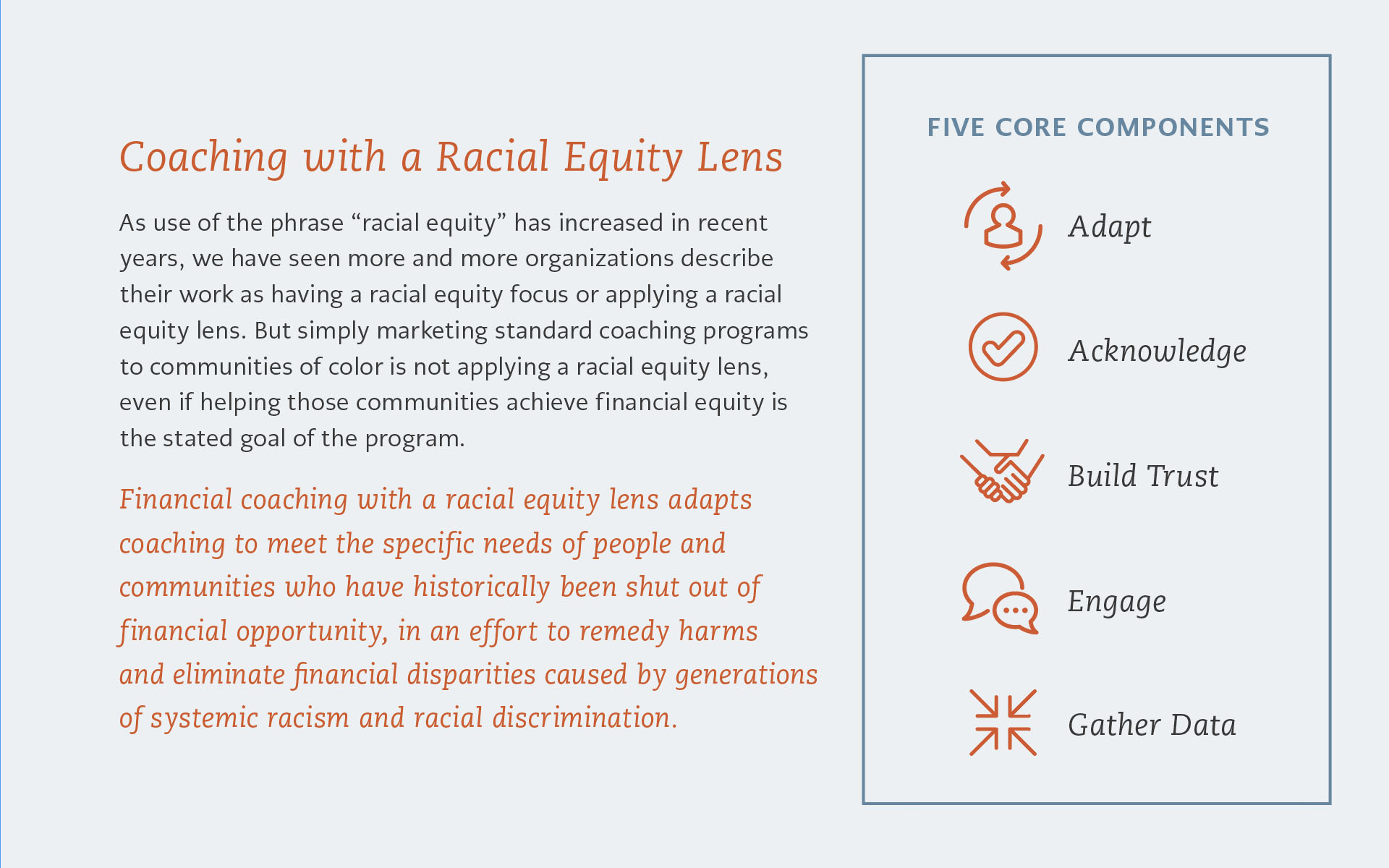

Simply serving a group that is disproportionately impacted—and giving them the same services provided to everyone else—does not equate to adopting a racial equity lens. Race has been used throughout history to discriminate. Simply applying “race-neutral” programs or policies ignores that reality and is not sufficient to address the harm caused by that legacy of disparate treatment. In fact, not acknowledging the way race and racism have shaped the lives of clients can impede the development of trust and authenticity in the coaching relationship.

The Racial Equity Lens

Introduction

The road to financial well-being is filled with pitfalls and promises. For Black, Latinx, Indigenous or Native, and Asian people, navigating that road means facing disproportionate fines and fees, higher interest rates on loans, and discrimination in housing and employment. These practices are layered on top of a legacy of structural racism that has historically denied access and opportunities for financial security and freedom to Black and brown people. While financial coaching is a proven strategy to improve financial outcomes for low- and moderate-income people and support them on the path toward achieving financial goals and financial well-being,1 the pathways are not equitable. As the field of financial coaching evolves, a critical gap is emerging.

- What is the best way to ensure that financial coaching is designed and delivered in ways that are inclusive, treat everyone justly according to their circumstances, and further racial equity?

- How can funders help grantees incorporate a racial equity lens into their financial coaching programs?

Background

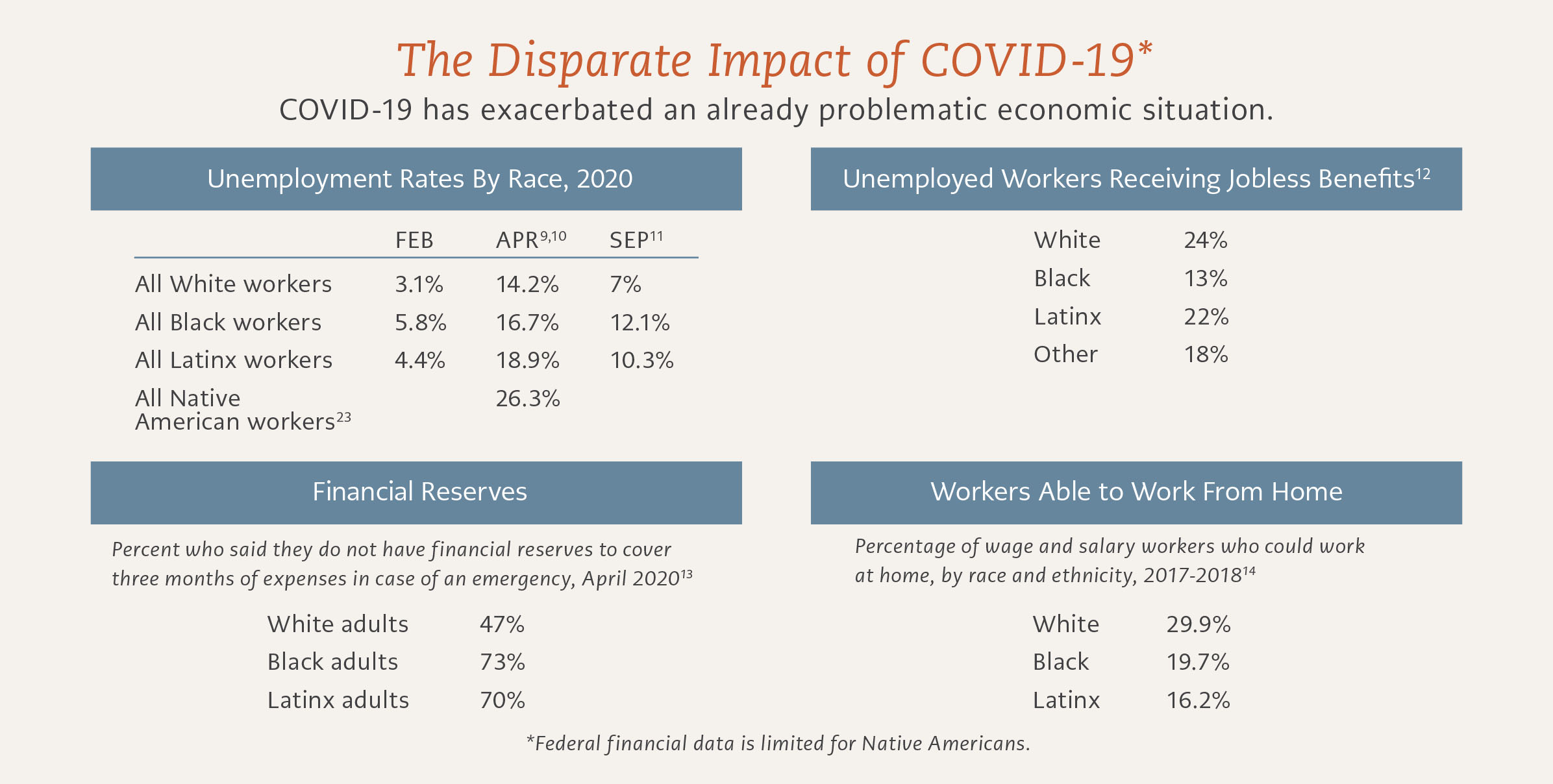

Black, Latinx, Indigenous, and Asian communities pursue financial well-being in the context of systems and structures that have discriminated against them for generations. Within what has been called a dual pandemic of COVID-19 and systemic racism, financial coaching has an opportunity to meet the needs of communities in new ways.

What is Financial Coaching?

Financial coaching is an approach to helping clients develop skills and behaviors that focuses on the client’s goals; in financial coaching, the client defines goals and solutions with the support of a coach. The underlying philosophy assumes the client is resourceful and capable of setting goals and solving problems independently, with support from coaching to improve skills.

Opportunity

The Opportunity for the Coaching Field and Philanthropy

Philanthropy is an important lever to affect a variety of systems that contribute to inequity; therefore, it has the opportunity to lead and fund in a way that models equity.

This paper generously sponsored by:

The Asset Funders Network (AFN) is a membership organization of national, regional, and community-based foundations and grantmakers strategic about using philanthropy to promote economic opportunity and financial security for low- and moderate-income Americans.

AFN works to increase the capacity of its members to effectively promote economic security by supporting efforts that help low- to moderate-income individuals and families build and protect assets.

Through knowledge sharing, AFN empowers foundations and grantmakers to leverage their resources to make more effective and strategic funding decisions, allowing each dollar invested to have greater impact.