For people across the United States, student loan debt is a growing portion of the household balance sheet. More than 40 million Americans have outstanding student loan balances. In 2019, the total amount of student debt owed surpassed $1.5 trillion, now the largest source of non-mortgage debt.

The burden of student loan debt is causing undue harm to the financial security of individuals and households across the US, with disproportionate impacts on both low- and moderate-income households and communities of color. Fifteen percent of adults have outstanding student loan debt. Within communities of color, the burden of taking on and paying back this debt is uniquely devastating. 20 years after enrollment, a typical black student still owes 95% of their debt, compared to 6% for white students.

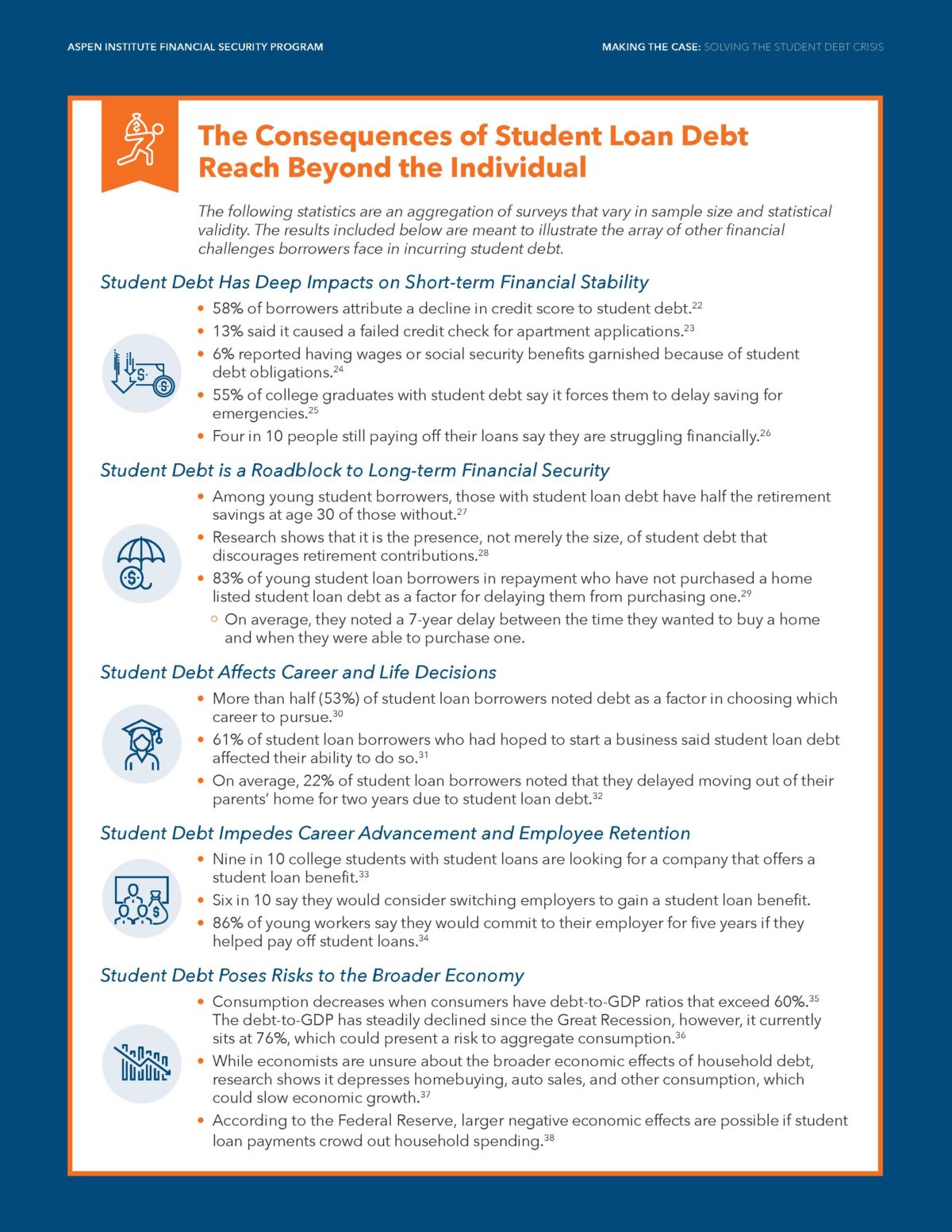

The problems associated with student loan debt are systemic and consequential for borrowers, their families, their communities, and for the nation’s economy. But these problems are also solvable. This brief outlines goals and solutions for crosssector action from federal, state, and local policymakers, employers, and other stakeholders to address rising student debt burdens, which have grown six-fold in the last 15 years. The brief explains the student debt crisis as it exists today, how it affects household financial security, and who is most impacted. Government officials, researchers, policymakers, private and nonprofit organizations, as well as the public, can use this brief for building momentum and driving action to solve this evolving crisis.

Download the Paper