Presented by:

What is Fintech?

Fintech, short for “financial technology,” loosely refers to products and services designed to let consumers and businesses conduct banking and other financial services digitally.

Louisiana funders can play a unique role in leveraging financial technology, or fintech, to help families meet their financial needs, promote digital equity, and improve financial stability for Louisianans.

This brief was created in response to growing interest in fintech across the state. Designed as a guide for funders, it provides a brief overview of fintech and its application in the financial health field, examines possible applications to Louisianans’ financial health challenges, and seeks to encourage funders to engage with fintech to support their grantmaking goals.

Key Benefits of Fintech

-

Lower costs

-

Simplified money management

-

Impact measurement opportunities

-

Improved convenience

-

Data-enabled solutions

Applying a Racial Equity Lens

Funders applying a racial equity lens to their grantmaking strategies should apply the same lens to any engagement with fintech. A racial equity lens can take a number of forms, including:

Funders applying a racial equity lens to their grantmaking strategies should apply the same lens to any engagement with fintech. A racial equity lens can take a number of forms, including:

-

Reviewing fintech user data disaggregated by race

-

Acknowledging that data and personal information have

historically been used against communities of color

-

Funding training for nonprofit fintechs and nonprofit service

providers

-

Engaging communities of color as experts

-

Lifting up nonprofit fintech founders of color

-

Working with local governments in rural parishes

Fintech for Louisianans

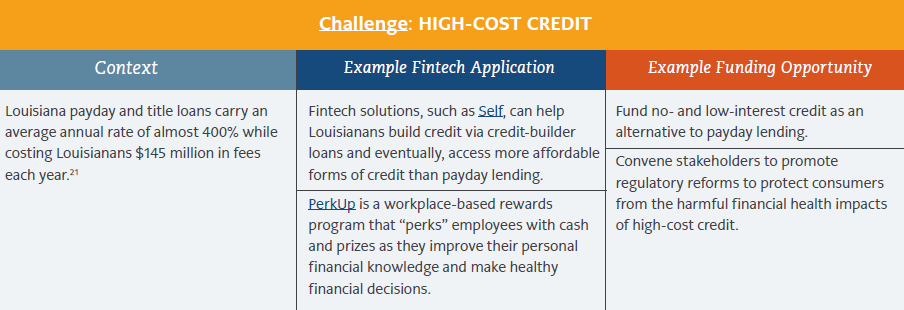

Conversations with Louisiana stakeholders identified several financial health challenges as particularly acute for residents of the state. For each of these challenges, a potential fintech application can improve the well-being of Louisianans and funders can help catalyze programs to connect consumers with fintech products and services.

The following is just one example from the brief that outlines these challenges and provides Fintech solutions and funding opportunities.

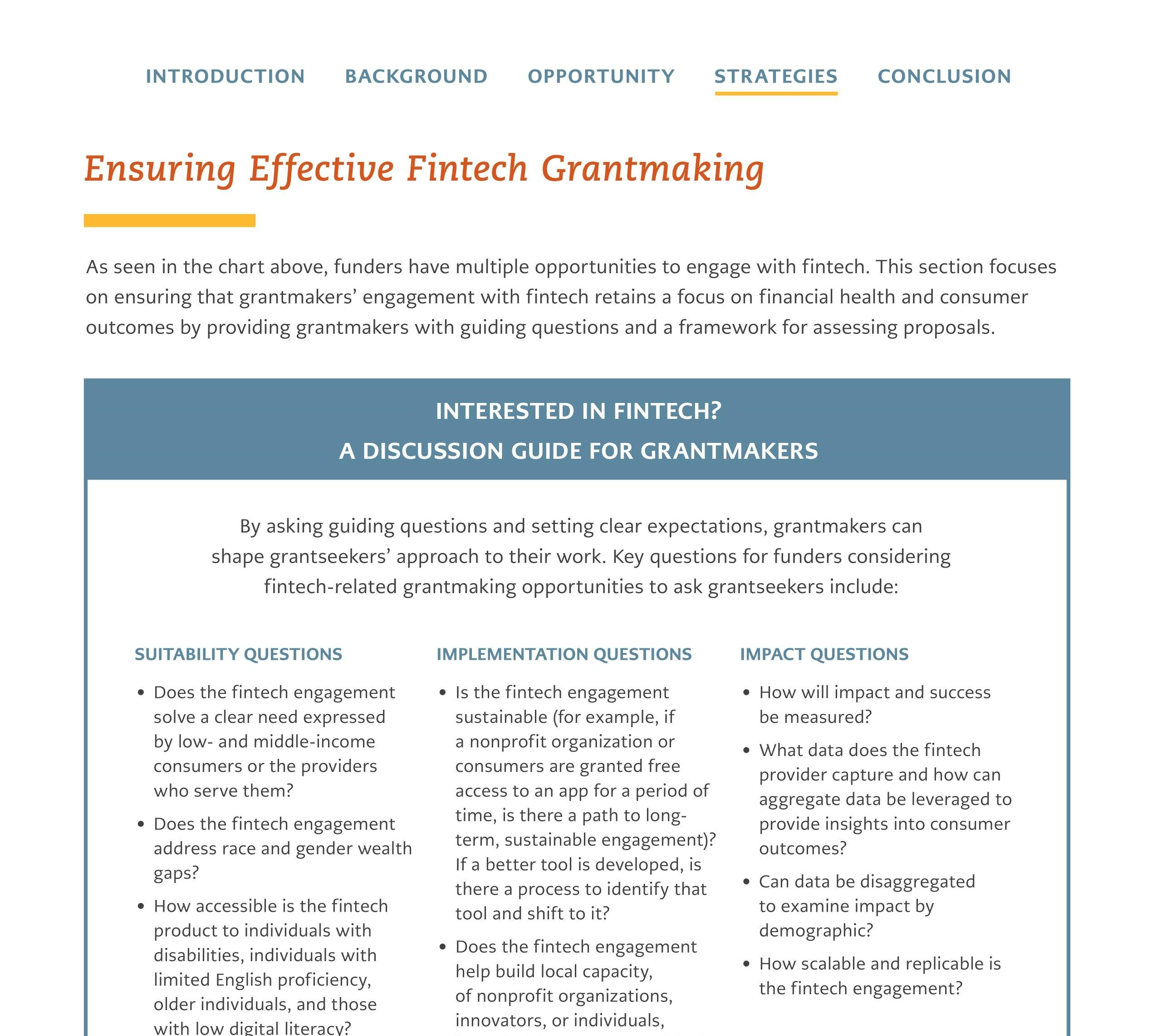

INTERESTED IN FINTECH?

By asking guiding questions and setting clear expectations, grantmakers can shape grantseekers’ approach to their work. Our brief includes key questions for funders considering fintech-related grantmaking opportunities to ask grantseekers.

Considerations for Funders

The pandemic and resulting economic fallout have underscored the need to connect individuals with technology that helps them weather crises, access relief, and build financial resiliency.

Fintech solutions featured in this brief show the promise of the fintech sector to enable an equitable recovery.

The discussion reinforces several key ideas:

Fintech is one tool among many to boost financial access and stability.

Fintech is one tool among many to boost financial access and stability.

Fintech dovetails with other high-priority issue areas for funders in Louisiana.

Fintech dovetails with other high-priority issue areas for funders in Louisiana.

Investing in fintech can enhance the capacity of an ecosystem of stakeholders, not just end users.

Investing in fintech can enhance the capacity of an ecosystem of stakeholders, not just end users.

Funders should consider foundational work that can make fintech work for consumers.

Funders should consider foundational work that can make fintech work for consumers.

The Financial Health Network unites industries, business leaders, policymakers, innovators, and visionaries in a shared mission to improve financial health for all. For 16 years, the Financial Health Network has increased awareness of specific consumer challenges, worked with providers to develop products and strategies to sustainably serve the underserved, and invested in innovative, high-quality products aimed at improving financial health.

The Asset Funders Network (AFN) is a membership organization of national, regional and community-based foundations and grantmakers strategic about using philanthropy to promote economic opportunity and financial security for low and moderate income Americans.

AFN works to increase the capacity of its members to effectively promote economic security by supporting efforts that help low- to moderate income individuals and families build and protect assets. Through knowledge sharing, AFN empowers foundations and grantmakers to leverage their resources to make more effective and strategic funding decisions, allowing each dollar invested to have greater impact.

Support for this Publication