Most American workers feel financial stress; the pandemic has only worsened it. Being an “essential worker” typically is not paid as if the work is essential. Jobs that can be performed remotely provide resilience, but predictably involve higher paid, higher educated workers.

Low and middle income workers face constant money worries, even before the extra stress imposed by the pandemic. They contend with exhausted emergency savings, debt to meet medical expenses or child care, irregular earnings, raided retirement funds, and family expenses to support a child’s education, aging parents, or underemployed relatives. Stressed workers struggle to achieve health, security, and asset-building goals.

AFN gathers and shares how philanthropic investment eases economic stress through employer offerings and advocacy on public policies. Employers can incent savings and provide benefits to reduce debt or build relevant assets; public policies can increase income, provide expense offsets with credits, or establish retirement savings vehicles.

Explore Employment

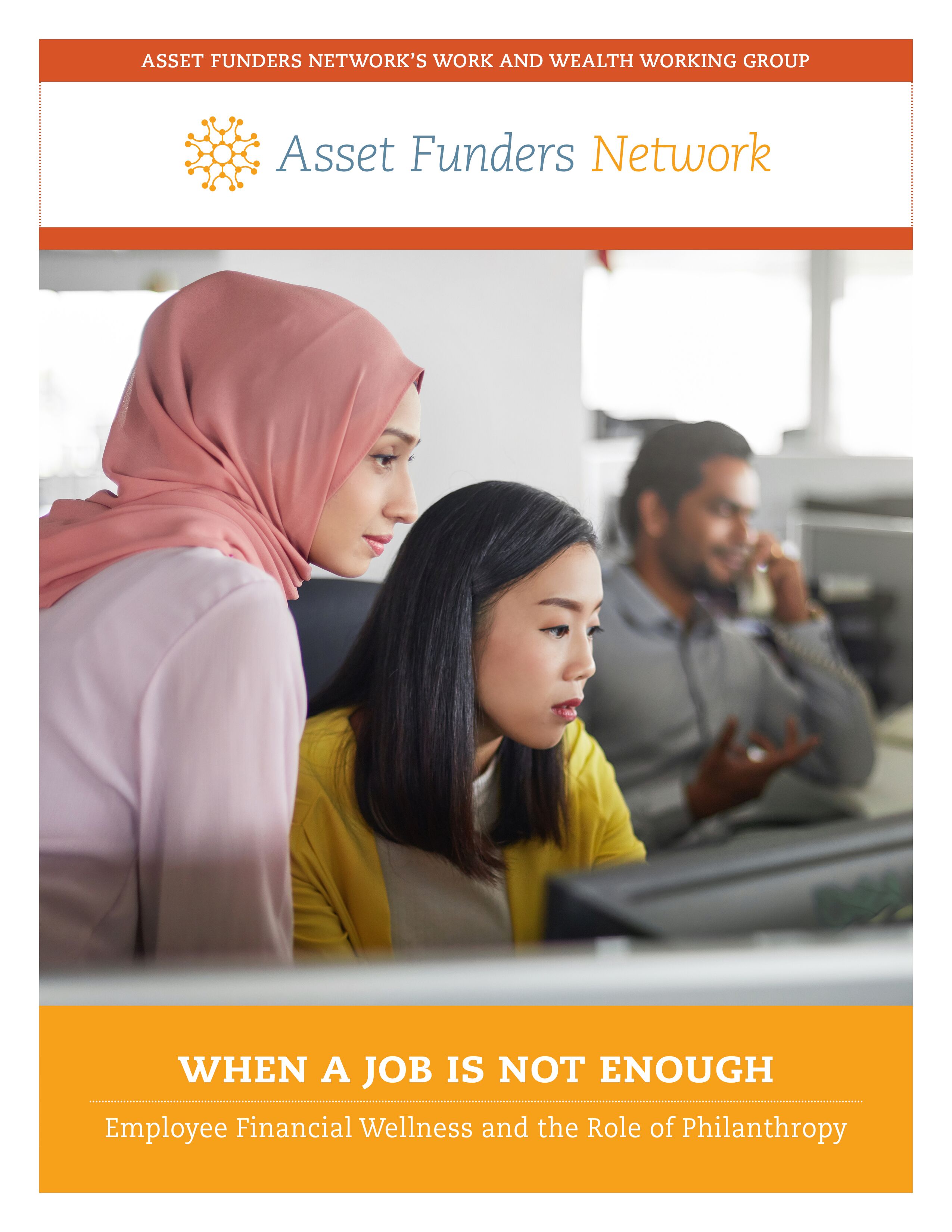

When a Job Is Not Enough: Employee Financial Wellness and the Role of Philanthropy

This report sheds light on the role employers and philanthropy can play in best promoting financial well-being for workers through the offering of Employee Financial Wellness Programs (EFWPs).

Why It’s Important

Grantmakers are investing to pilot strategies, research effects, and advocate for increased equity both by supporting equitable wages and benefits and reducing financial stressors. Boosting economic foundations through employers and/or public policy reforms.

Increases the link between of productivity and higher wages for essential work

Reforms tax policy to increase income, savings, and education credits

Eliminates tip wages and creates living wages as a minimum

Increases resilience with basic and supplemental guaranteed income

Supports paid time off across all sectors

Provides for secure retirement options

Reduces or eliminates employer health insurance costs and medical debt

Links post-secondary and good jobs to asset building strategies

Grantmaking Strategies

Everyone needs to spend, save, and borrow to build financial resilience. Before 2020, one-third of workers report distraction due to worries about financial necessities. That distraction comes at a cost, to individuals, employers, and the economy. Indeed, not having disposable income after necessary expenses makes asset building seem unattainable. Building an equitable economy means increasing disposable income to build wealth.

Employer-based approaches can boost employees’ economic well-being and wealth. A variety of apps, holistic programs, and practical products can engage employees in improving their financial health. Fringe benefit solutions can:

- reduce employee spending on transportation or child care,

- pay educational debt,

- extend lower cost loans to reduce financial stress,

- provide paid time off to increase security,

- offer pay advances to smooth income, and

- make financial coaching available to all employees.

Payroll deductions and employer incentives can build and rebuild emergency savings, support goal focused savings, and fund retirement accounts. Grantmakers also have led the way in piloting approaches with employers to help workers get upskilled and advancing an equitable, inclusive post-secondary pipeline for resilience in future employment.

Investments in research, education, pilots, and advocacy effectively inform advocacy to change public policy to increase disposable income for asset building and economic security. State and federal tax reform to increase income through earned income tax credits and child care credits; tax incentives for savings or home purchase; education debt forgiveness; and direct supports such as guaranteed income can help build resilience and reduce vulnerability to financial shocks. And Secure Choice efforts by states expand retirement accounts to workers without an employer based option. Finally, economic case-making to raise minimum wages, to eliminate the anachronistic tip wage minimum, and to ensure paid time off are keys to increasing the capacity to build wealth.

At a local level, grantmakers support equitable economic development creating lasting jobs for those in the community and invest in proving employment for those returning to community is key to increase justice and reduce recidivism. Grantmaker funded research and advocacy to eliminate inequitable fees and fines and to reform justice systems used for aggressive debt collection also increases disposable income.

““Promoting economic opportunity is critical for the growth and resiliency of communities and the economy. JPMorgan Chase is committed to helping low income households access a good job paired with asset-building products and services to improve their economic trajectory.”

Colleen Briggs | JPMorgan Chase & Co.